Plenty of mystery and controversy surround the Tether (USDT) cryptocurrency asset, if you can even call it that.

This post won't provide any illumination towards Tether; in fact, USDT looks all the more mysterious, and something that should be investigated.

Fundamentally, Tether is supposed to act as a dollar substitute. It's designed to track the value of the dollar in a one-to-one ratio. That means that people on Bittrex, for instance, can sell their crypto holdings and acquire USDT. Should the cryptocurrency market tumble like it did recently, these investors are protected.

Supposedly, it's a great investing hedge in the cryptocurrency sphere.

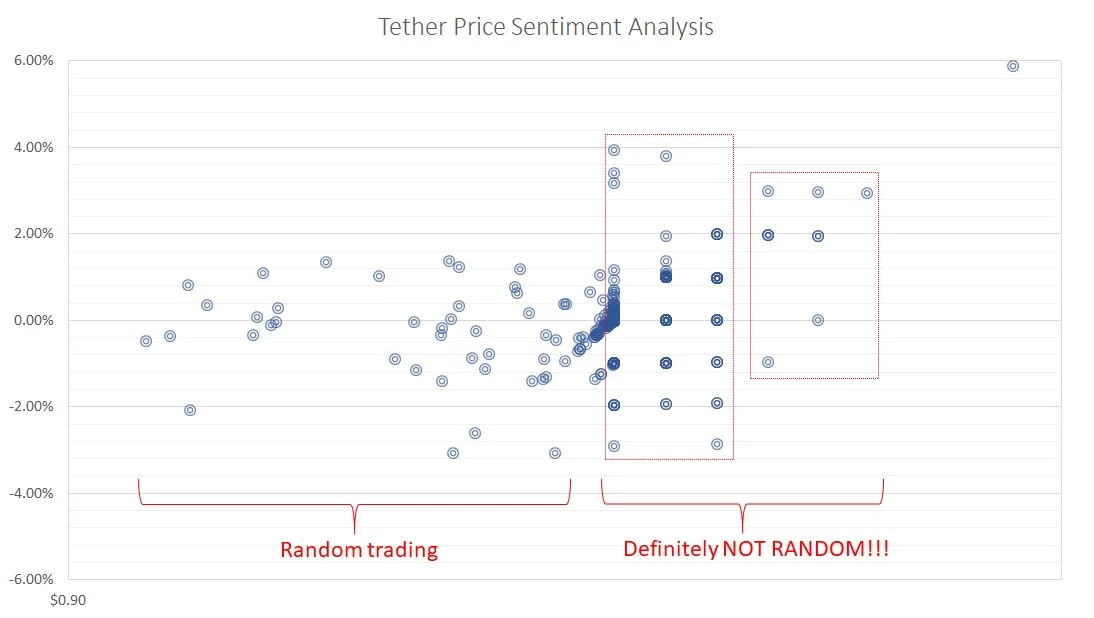

But check out my price sentiment analysis for Tether (USDT):

Come on, that's some weird sh*t, as I'm sure you'll agree!

What in the world is up with this centralized trading pattern inside an asymmetric rhombus?

But the real craziness begins when you drill deeper into the Tether price sentiment analysis...

Tether Exposed!

What the hell!?!???

Tether is a combination of random trading activity combined with absolutely, non-random trading!

As USDT approaches the $1 mark, the trading transitions from random to non-random, almost as if it has breached singularity!

Now that's some #weirdscience if I may say so myself!

Any thoughts on Tether (USDT)? Sound off on the comments section!