Now that the month of April has officially ended, I would just like to document and summarize all the financial transactions I did within the month. I actually did the same for the first three months starting January to March this year, and you can see full of it HERE. Afterwards, I tried to come up with a weekly financial assessment which started on the first week of April as follows:

- My Weekly Financial Assessment for the First Week of April 2018

- My Weekly Financial Assessment for the Second and Third Week of April 2018

I am supposed to assess my weekly financial activities for the fourth week of April in this post but since it’s a month-ender, I will add my overall financial standing for the month of April 2018. At the end of this post, I will lay all my financial plans for the next days and months to come. So then, I have something to look back and evaluate whether I have accomplished the ones I am promising to myself at the moment.

Disclaimer: I honestly don’t think most people will find this personal financial summary an interesting piece to read, but I hope this will inspire you to keep pushing on your life’s financial goals.

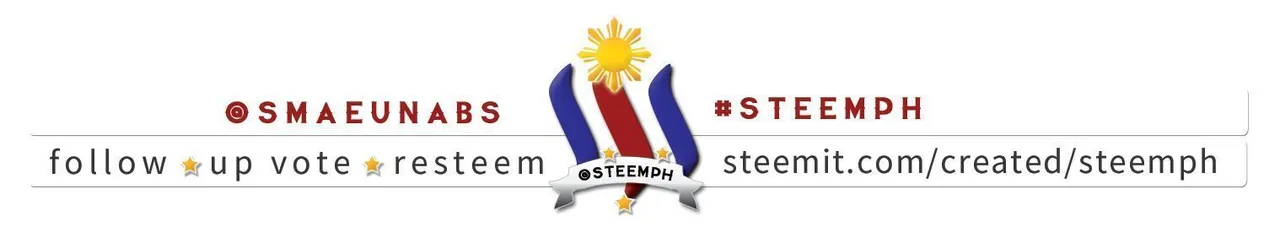

Income for the fourth week of April (April 22 - 30)

I am a full-time worker having a 7am-4pm job. Our monthly salary is given on the 7th and 22nd of the month. (Don’t ask me why, it’s a long story). But if those days fall on weekends, we automatically get our pay on Fridays. Since April 22 fell on Sunday, I got my salary for the second half of the month on April 20, Friday, and it was already included in my third weekly financial assessment.

As usual, my income for the last week of April is coming from my Sidelines (including my Steemit earnings), loading business, and others (when a friend returned the money she borrowed). If you are wondering about the “Emergency Savings” portion, that is not really an income but an emergency fund I established for family contingencies. I got a portion of that emergency fund and you will know why on the expenses portion. I still consider it as an income since everytime I save or invest something, I always consider them as expenses or the money is gone!, so the moment they go back to my wallet, they are already considered as income.

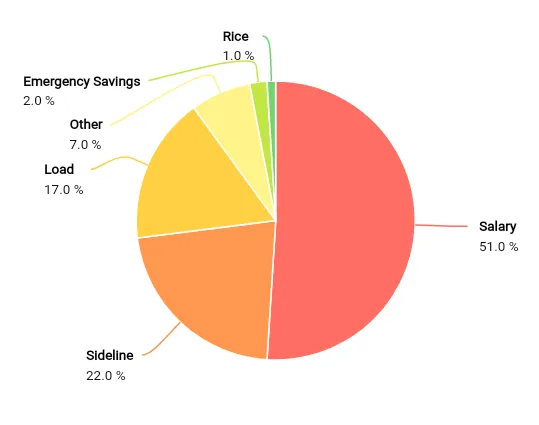

Expenses for the fourth week of April (April 22 - 30)

One thing I love about making financial assessments like this is the fact that my financial conviction strengthens even further. In the past week, several unexpected expenditures showed up so I promised myself to catch up with my Travel fund, and as you can see, this is my priority this week. As usual, I have my food, transportation, and load expenses. I also allocated some of my earnings for my sinking fund.

The “Emergency” portion actually equates to the “Emergency Savings” above. I usually leave one of my ATM cards as “Family Emergency Fund” at home so in cases of emergencies, my mom will have something to turn to. This time, she forgot to pay our water bill and she was running out of cash that time. Mind you, if it wasn’t because of that emergency fund, I will never be able to take a bath today.

This week, my social activities’ expenses are pretty significant unlike the past few weeks since I engaged in two social activities. The first one was the Steemsummit while the second one is the “botong (coconut) session” and unwinding session with my high school buddies.

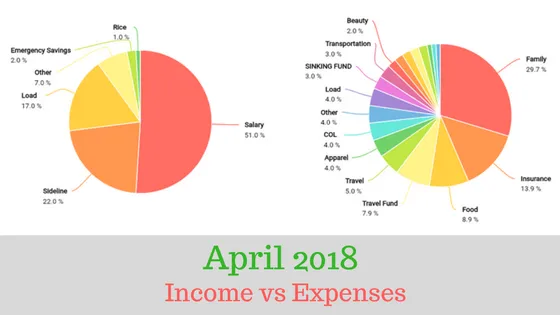

Income vs Expenses for the month of April

Basically, half of my total income for this month came from my salary. The other half came from my sidelines including Steemit, loading, and rice businesses. I honestly don’t know if I could realize my financial goals this month if it weren’t because of my rakets.

My four major expenditures this month is for my family, insurance, food allowance, and travel fund. Overall, I am very happy with how I managed my finances for the month of April since I hit all my target amounts for my savings and investments. And in order to have something to look forward, I am making this list to remind myself of my short-term financial goals:

- Financially prepare for my sister’s birthday

- Allocate insurance payment every payday. Don’t wait for quarterly due dates. Next insurance payment due : July 2018

- Reach the travel fund target before September (Coron, Palawan trip)

- Continue building emergency fund until it reaches a hundred thousand

- Start saving for the next cycle of FarmOn.ph investment

To my fellow Steemians, may this financial assessment teach you the importance of tracking your actual income and expenses. I assure you, this will save you a lot of time thinking about how and where your earnings went.

I am using this Money Manager app and all I’ve got to do is to input all my daily income and expenses down to the very last cent. The charts you saw above are just a few of the app’s features in converting your actual financial activities into statistical reports.

May this leave you a lesson not to stick with one source of income as well. There are many opportunities available for us to earn in order to increase our cash inflows. You just have to be courageous and disciplined enough if you want to realize all your financial aspirations.

May your dreams come true,

@smaeunabs

I am currently initiating a finance related contest entitled "The Budget Challenge". If you are interested to join, see the full mechanics HERE

Previously-posted finance-related articles that you can learn from:

The Silent Phase of the Market Will Reveal The Investor In You

Different Investment Vehicles that You Can Ride Towards Financial Freedom

A Summary of My Financial Activities for the First Quarter of the Year

My Credit Story: How I Managed to Pay-Off Someone Else’s Debt

How Does Decisiveness Affect Your Finances: Explained Through Trading SBD on Bittrex

Three Important Things to Learn from Cryptocurrency Market Crash

Understanding Money’s Liquidity: How to Apply it to Steemit Earnings?

Eight Lessons From “The Budget Challenge” Everyone Must Learn From