Thorchain is a unique protocol with a goal to enable DeFi using native assets. It is a decentralized cross-chain liquidity protocol that enables the exchange of native layer-1 assets such as Bitcoin (BTC), Ethereum (ETH), and others in a permissionless way.

Unlike most of the other DEXs and DeFi protocols, that are using wrapped versions of other tokens on their network, Thorchain enables native coins to be swapped between each other. For example, the biggest DEX, Uniswap has WBTC (Wrapped Bitcoin) on the Ethereum network and then it allows this Bitcoin synthetic asset to be used on the Ethereum network. This comes with more risk added, as the issuer of the WBTC tokens on Ethereum needs to hold the appropriate amount of BTC on the native network at all times. It’s a similar situation for other tokens and networks.

Insolvency Issues

Thorchain started experimenting with new features and one of them was lending. The thing is the way they implemented had inherent risk into it. No interest, no liquidation. Users can deposit native BTC and borrow USD. BTC is locked in vaults as a collateral, but the protocol uses it to buy RUNE and generate liquidity. When users want to redeem the collateral, the protocol needs to mint new RUNE, buy BTC and give back the BTC. As the price difference between RUNE and BTC grows in favor of BTC withdrawing BTC becomes expensive for RUNE, minting more and more tokens to give back the collateral. More tokens create sell pressure, pushing the price down, that results in even more new tokens needed, ending in a death spiral. This is just a short description of the situation and not totally accurate. Back in January and February od 2025 the protocol stopped this program and created a long term program to refund the loss of the users who had locked collateral via the fees and the revenues it creates in the future and a new token around this that is basically bearing the yield from the fees.

New features are always risky but the speed this situation evolved to a total thread to the L1 protocol is reckless. I remember there were caps on new things slowly raising them. Here this is obviously not the case, and it grows to big to fast.

Here we will be looking at:

- Total value locked TVL (collateral)

- Trading volume

- Transactions

- Top tokens

- Defi protocols rank by TVL

- Price

The data here is compiled from different sources like DefiLama and Runescan.

Total Value Locked

Here is the chart for the total value locked in the protocol.

We can see the sharp drop at the end of January 2025 when the lending crisis happened and around 200M in collateral was basically removed. It has created a big dump in the overall liquidity of the protocol with under 100M in TVL left after it. In the very last month we can notice a very small recovery around it.

Prior to this the protocol had reached 500M in TVL back in 2024 and close to 400M at the end of 2024.

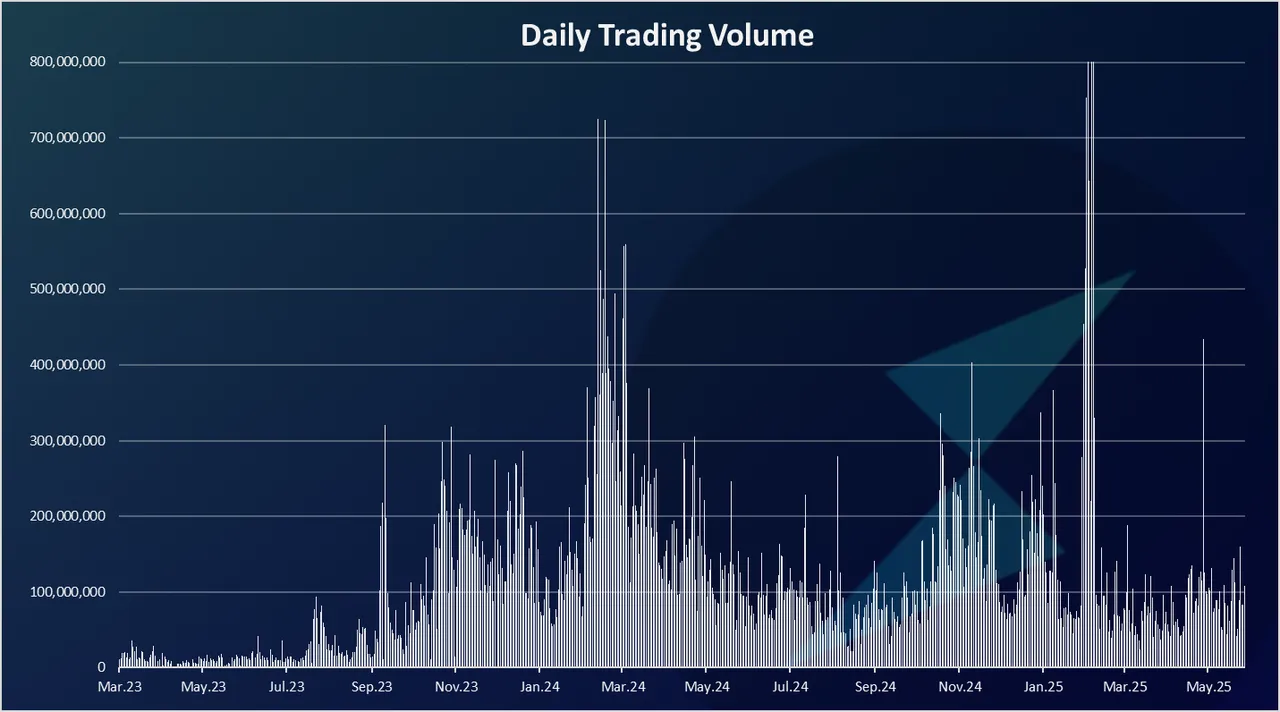

Trading Volume

Here is the chart for the daily trading volume on Thorchain.

We can see the significant growth in the last period in the trading activities on Thorchain. Unlike the TVL where the recent spike is at the levels of the previous bull market, the spike in the trading volume in 2024 is much higher than the previous bull market. Meaning a lot more trading activity has been going on, and the protocol is much more used.

Back in 2024 the daily trading volume reached 1B for a few days. In the recent period it has been in the range of 100M to 300M daily.

On a monthly basis the chart looks like this:

We can see the spike in March 2024 with more than 10B in trading volume. This is an ATH for Thorchain. A drop since then and the protocol is in the range of 2B to 5B. Overall the trading activity has been doing quite well having in mind the lending crisis.

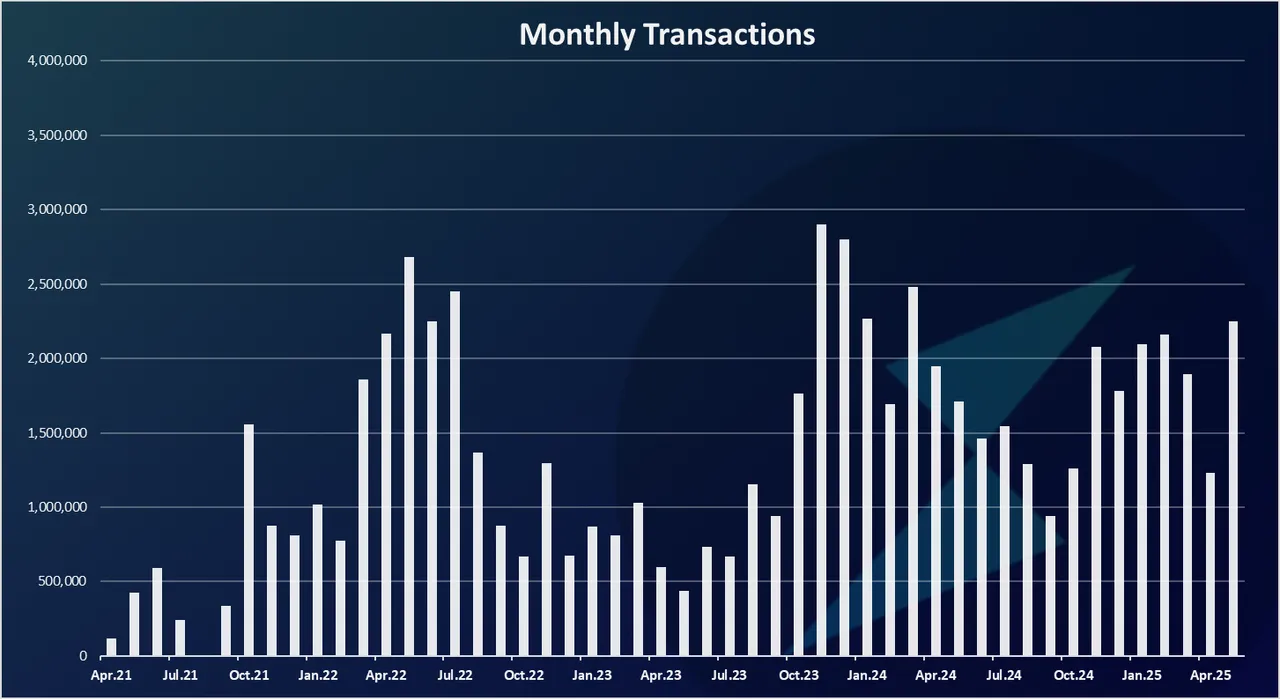

Transactions

The data for the number of monthly transactions looks like this.

These are monthly transactions.

We can see that when it comes to the monthly transactions, the recent numbers are on the levels of the previous bull market at around 2.5M monthly transactions or close to 100k daily transactions.

In the last months this number has been around 1.5M to 2M.

Top Coins

Which coins are deposited the most on the Thorchain protocol. Here is the chart.

Bitcoin comes on the top here with more than 60M liquidity, followed by Ethereum and then the stablecoins USDC and USDT with around 12M each.

Other native coins that are supported are BCH, BNB, AVAX, DOGE and LTC.

Top Defi Protocols Ranked by Trading Volume

How is the Thorchain protocol doing when compared to the other ones? The trading volume is usually one of the metrics these protocols use.

Here is the chart.

This is a one day trading volume.

Pancake and Uniswap are on the top now, followed by some Solana DEXs. Thorchain just managed to stay in the top 10 with around 100M daily volume.

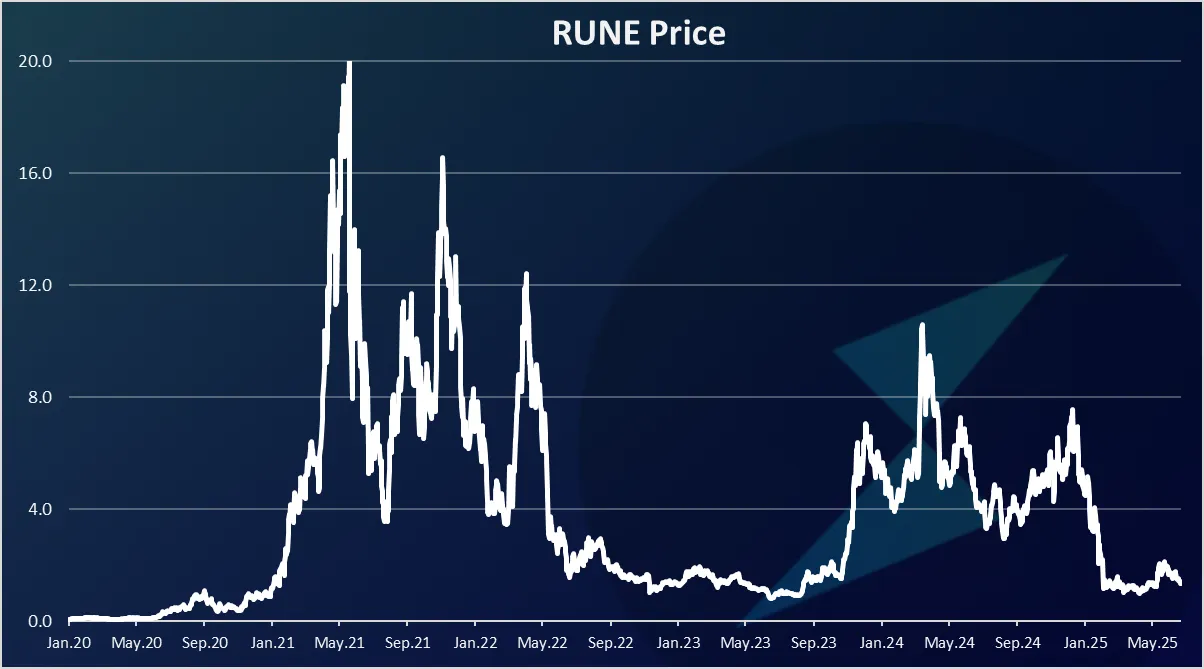

Price

Here is the chart for the RUNE token.

Quite a wild ride for RUNE, going from a few cents in 2020 to $20 in 2021, and down to 0.8 USD in 2023. A growth in 2024 and now a drop again to the 2$ levels.

We can notice that prior to the lending crisis, the RUNE token was almost at 8$, but a sharp drop since then and it is now at around 1.3$, bellow the 2$ mark.

Obviously Thorchain has taken a big hit in the last period, the token price and the TVL have went down a lot, but on the positive side there is still swapping going and the DEX is working.

All the best

@dalz