Blockchain economies stand at a critical inflection point. The initial exuberance surrounding token launches has given way to sobering realities about sustainability and value creation. What's increasingly clear is that tokenomics the economic design of digital assets requires a fundamental shift toward macroeconomic principles that have governed traditional economies for centuries. This evolved approach, which we might call "macrotokenomics," represents the necessary maturation of an industry still finding its footing.

The Limitations of First-Generation Tokenomics

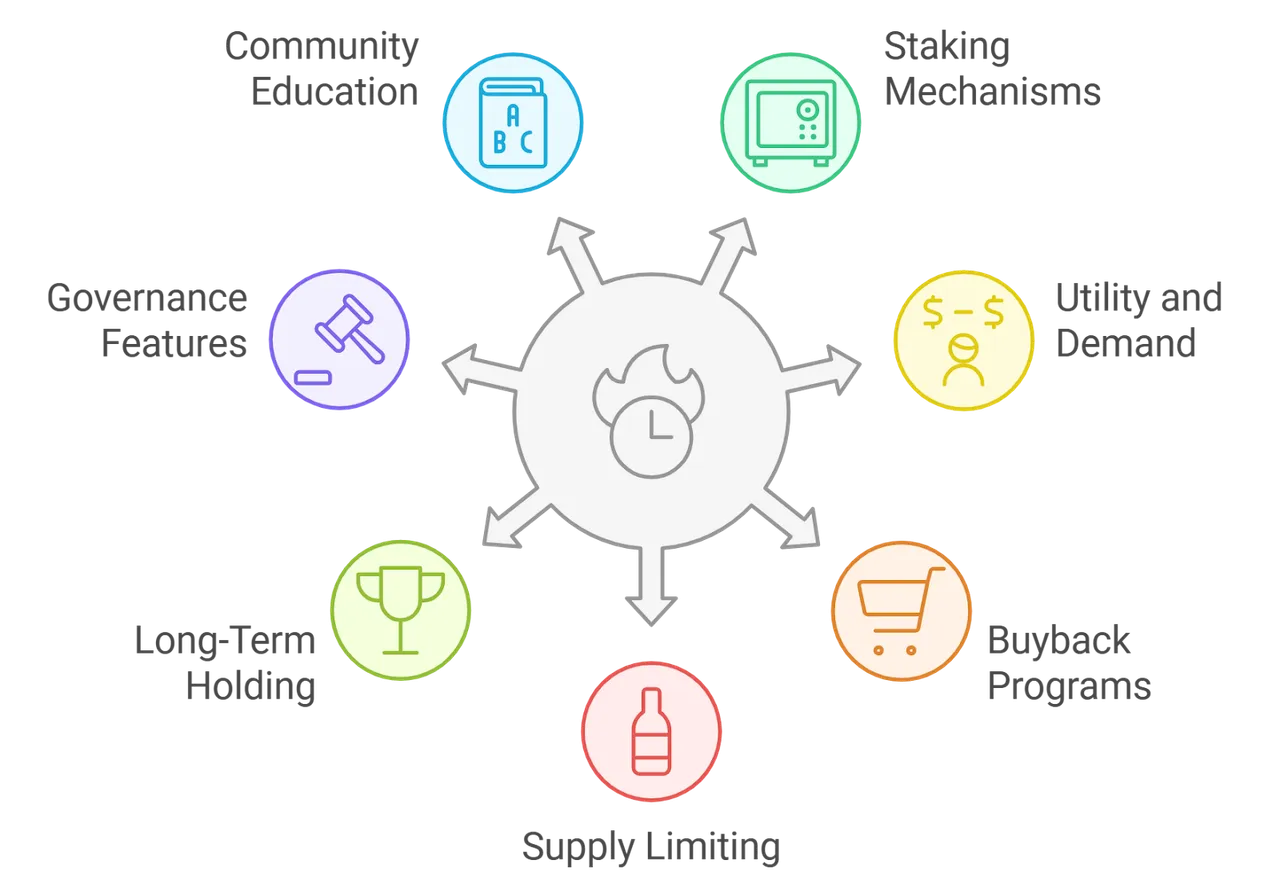

Token economies have predominantly focused on microeconomic mechanisms: supply caps, burning mechanisms, and staking rewards. While these tools create short-term value narratives, they often neglect the broader economic ecosystem in which tokens exist. Projects implementing arbitrary emission schedules or deflationary mechanisms without consideration for actual utility often face inevitable collapse once initial enthusiasm wanes.

Research from the Digital Assets Research Consortium reveals that 78% of tokens launched between 2017-2021 lost over 90% of their value within three years, with poor economic design cited as the primary failure factor in 63% of cases.

Defining Macrotokenomics

Macrotokenomics applies established economic principles at the system level rather than focusing exclusively on token mechanics. This approach incorporates:

- Fiscal and monetary policy frameworks adaptable to on-chain governance

- Productivity and value creation metrics that extend beyond transaction volume

- Counter-cyclical stabilization mechanisms to mitigate volatility

- Sustainable growth models prioritizing long-term ecosystem health

Professor Elena Mikhailov from the Blockchain Economics Institute notes, "Successful token economies need to be designed with the same attention to comprehensive economic principles as national economies, just adapted to their unique digital context".

The Velocity Problem and Its Solutions

One of the most significant challenges in token economies is managing token velocity the rate at which tokens change hands. High velocity can undermine value accrual even in projects with substantial adoption. Macrotokenomic approaches address this through sophisticated mechanisms:

- Economic sinks that create natural demand for holding tokens

- Utility-driven staking that ties financial rewards to ecosystem participation

- Governance structures that reward long-term alignment

The Crypto Policy Research Group found that protocols implementing macrotokenomic principles showed 340% better token value retention during market downturns compared to those using only supply-side mechanics.

Real GDP Equivalents in Token Ecosystems

Traditional economies measure success through metrics like GDP, which quantifies actual value creation. Token economies require similar measures beyond market capitalization or transaction volume.

Progressive projects are now implementing:

- Value-added metrics measuring contributions to the broader ecosystem

- Productivity indices tracking efficiency improvements in protocol operations

- Network effect multipliers that quantify compounding utility

"We need to move beyond vanity metrics toward substantive measurements of economic value creation," argues Dr. James Chen, economist at the Digital Currency Initiative.

Implementing Counter-Cyclical Mechanisms

Boom-bust cycles plague cryptocurrency markets, but macrotokenomic design can implement counter-cyclical stabilizers similar to those used by central banks and governments:

- Algorithmic treasury management that accumulates reserves during upswings

- Dynamic fee structures that adjust to market conditions

- Strategic protocol parameter adjustment through predetermined formulas

The Ethereum-based lending protocol Compound demonstrated the effectiveness of such approaches by maintaining liquidity through the 2022 market downturn via its counter-cyclical reserve factor.

Governance as Economic Policy

In macrotokenomics, governance becomes an economic policy instrument rather than merely a voting mechanism. Effective token governance:

- Allows calibration of economic parameters based on changing conditions

- Provides checks and balances against short-term extractive proposals

- Facilitates ecosystem-wide coordination around economic objectives

"Governance is not just about technical decisions; it's fundamentally about stewarding the economic future of the protocol," states blockchain governance researcher Sarah Williams.

Building Sustainable Token Economies

For token economies to achieve long-term viability, projects must embrace macrotokenomic thinking from inception. This includes:

- Economic simulation before implementation, testing designs across various market scenarios

- Interdisciplinary teams incorporating economists alongside developers

- Transparent reporting on economic health metrics

- Gradual implementation of economic mechanisms with feedback loops

The Advanced Blockchain Economics Forum recommends a standardized framework for token economic assessments that evaluates projects based on macroeconomic principles rather than marketing narratives.

Conclusion

By learning from centuries of economic theory and practice, while adapting to the unique characteristics of blockchain technology, macrotokenomics offers the blueprint for the next generation of resilient digital economies. The industry's maturation depends on this shift from short-term tokenomics to sustainable macrotokenomic design.