Welcome to some deeper knowledge on forex. By now, if you have been following along in the course without skipping forward, you are ready to learn about how to read and calculate various aspects of forex. We will be talking about these main points today:

- Forex Quotes

- Forex Commission

- Forex Rollover

- Forex Bid/Ask

- Forex Leverage and Margin

- LOT Size

What is a forex Quote?

Forex is quoted a bit differently than stock, futures, and the like. When we look at a forex quote, we are looking at the exchange rate between 2 separate currencies, instead of just one security. This is because if we want to trade the economy of the United States, we can do this with futures, stocks, etc… but if we want to trade the economy of the United States versus the economy of Switzerland, for example, we can do this with forex. Each quote represents a currency of one country pitted against the currency form another country.

What we are trying to see is the ‘exchange rate’ between the two countries. When you go to an airport currency exchange kiosk and try to exchange your U.S. Dollars for Swiss Francs, there is an exchange rate. For instance, ” How many candy bars can I buy in Switzerland with my U.S. Dollars?” Well you will have to exchange your money for Swiss Francs and use that to buy those delicious candy bars.

Now when you look at the forex quote above, you can notice that they always have a currency on the left and one one the right. The currency on the left is called the BASE currency and the one on the right is called the counter currency.

EUR/USD – EUR is the BASE currency and USD is the COUNTER currency.

The currency on the left is always ONE unit. For instance in the quote EUR/USD, it takes 1 EURO to buy the equivalent of the counter currency, the U.S. Dollar.

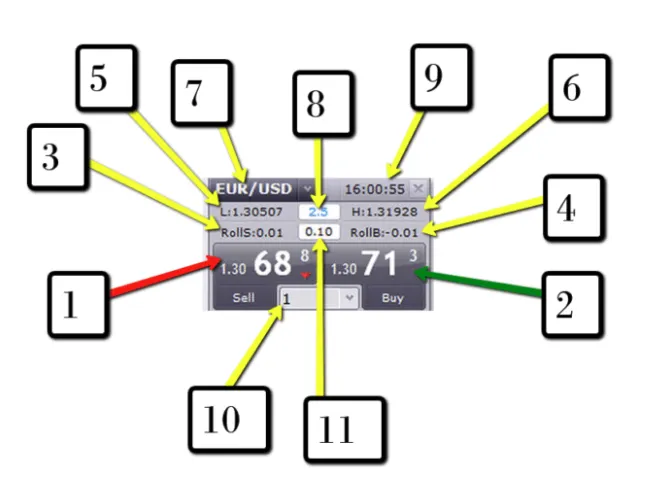

Take a look at the Above Picture and we will explain what all the numbers mean.

BID/ASK (Numbers 1 and 2 above)

#7 above shows the currency pair. The EUR/SD.

There is a bid price and ask price. The price on the left (#1 Sell at 1.30688) and the price on the right (Buy at 1.30713) are the BID/ASK prices. The price on the left is where you can SELL or short the pair right now and the price on the right is the price you can buy or go long the pair right now.

Now why are there different prices? Well, young lad, the difference in the prices is how your broker makes money for offering you the opportunity to trade with them and offer liquidity. The spread on this pair is 2.5 pips. A 2.5 pip spread is about average for most brokers. How do I know it is 2.5 pips? I am glad you asked but first I will ask you a question, ” Did you read the module where I covered what a pip was?” If you didn’t then quit trying to skip ahead and go read that part, you lazy turd! 🙂

Here is the calculation

1.30688 MINUS 1.30713 = 0.00025. Remember the 4th decimal is the pip. 0.0002 is 2 pips. and 0.00025 is 2.5 pips. This is the compensation to the broker. Some brokers have large bid/ask spreads and some have almost zero. It all depends on what your broker can offer you.

Also, there are brokers that have fixed spreads and ones with floating spreads. These are just different pricing types. Do you want to know that your spread will ALWAYS be a certain pip? If so, choose a fixed spread broker but BEWARE!!! If you choose a fixed spread broker, you may very well be trading against your own broker and this can sometimes be a conflict of interest.

#8 shows the spread for you, so you do not have to calculate it on your own.

Commission (Not listed in the quote)

Some brokers charge a commission on each trade but also charge an insanely low bid/ask spread. My FXCM account charges me around 0.3 pips for each trade and I pay a small commission for each trade placed. That’s not 3 pips but rather 3/10ths of 1 pip. This is extremely low. Quite often, you will find that the larger your account is, the lower the spread your broker will offer. Likewise, the larger your account, the smaller your commission per trade (relative).

Rollover (Numbers 3 and 4 above)

There is a neat little thing in forex called rollover. Did you know you can get paid just to hold a trade open. It is similar to dividends in stocks. Whether the market goes up or goes down, as long as you are holding that trade, you will get paid every day. There is a dark, sinister side to this as well. You can also get charged a rollover fee every day if you are holding in the wrong direction. It all depends on the interest rates of each country.

You most likely know what an interest rate is but I will explain it and this will help you understand what rollover is. In layman’s terms, an interest rate is the amount of money that you pay on a loan and also the money you receive for having a savings account at your local bank. You either pay it or you receive it. Now if your interest rate for your savings account is 1% for keeping money at your bank, do you think the bank would charge you less than that to take out a loan?

Here is the answer…

Of course not! Here is why… If your bank would pay you 1% for your savings and only charge you 0.5% on a loan, then everybody and their brother would start taking out loans and putting the money in their bank accounts to earn free interest on risk free loans.

However, here is a dirty little secret… You CAN do this in forex! It’s called a carry trade. t doesn’t work as well as it used to, by the way, but can still work).

Anyhoodles, rollover is comprised of taking the interest rate from one country and plotting it against the interest rate of another country. The country with a higher interest rate pays you and the country with a lower interest rate sucks your money. Take a look at the following picture I pulled from fxstreet.

You can see that if you were holding the NAD/CHF long overnight, you would make money and if you held it short (selling), you would have to pay money. The reason you can make money, just by holding this position is the fact that the NZD interest rate was higher than the CHF interest rate at the time.

I am not getting into all the technical mathematics but let’s pretend the Australian Dollar interest rate is 5% and the United States interest rate is 1%, then you can buy Australian Dollars and earn interest and you can sell U.S. Dollars and pay interest but you will earn more AUD interest than you pay in USD interest and this will make you a risk free profit on the rollover. However, it is not a risk free trade because of the fluctuations in the price movements of the AUD/CHF.

Rollover is paid at 5pm Eastern every day, even if you open a trade at 4:59pm and close it at 5:01pm. I highly suggest you NOT doing this because price spikes occur at 5pm for this very reason. Rollover is being paid at this time.

High/Low (Numbers 5 and 6 above)

This just shows the high and low of the day. I don’t know why they include it in the quote but whatever.

Leverage and Margin (Not Listed in the above Quote)

Ok here is the part that traders either love or it kills their account in one trade. Pay attention!!! In forex, did you know that you can control $1,000 by only putting up only $1 in certain instances? I HIGHLY suggest NOT doing this! I will show you the proper way to apply leverage to forex without blowing out your account.

Definition of Margin – A margin consists of borrowed money that is used to purchase securities. This practice is referred to as “buying on margin”.

Definition of Leverage – Leverage is the use of various financial instruments or borrowed capital, such as margin, to increase the potential return of an investment.

In an everyday example, here is how it works: Let’s pretend you are buying a house that costs $100,000 and you put down a 10% down payment of $10,000 and take a mortgage for the rest. Now you are controlling a $100,000 security with only an outlay of $10,000. This is known as 10:1 leverage.

First I will explain how overleveraging will kill your account. Let us take a stroll down 2008 Avenue. Back then, the banks were offering virtually anyone the opportunity to buy a house, even if they couldn’t afford it, and this caused causing prices to increase dramatically. Sometimes, borrowers were buying a house for $100,000 for nothing down (Or like $100) and they were using 1000:! leverage (controlling $1,000 with only $100). Well when the housing bubble burst, these borrowers were on the hook for highly overpriced houses, with no way to repay and lost everything.

The same applies to forex. Your broker will allow you to leverage your account (trade larger than what you have in your account). This can work in your favor as well as work against you. If you are smart and don’t over-leverage, you should be fine. Use your brain and tell me which one would be a safer investment…

Trader A buys an investment for $100,000 and puts up $50,000 as a down payment. If the house climbs to $150,000, the trader can double his money.

Trader B buys an investment for $$1,000,000 and puts up $50,000 as a down payment. If the investment climbs to $1.5 million, the trader make a killing!

Trader A is a wiser investor because he is not overleveraging. Trader B is a dumb ass and will most likely lose all of his money. Here is why…

#10 shows how many lots you are trading

#11 shows how much your lots are worth per pip. 0.10 means the trade is worth 10 cents per pip.

Lot Size

Each forex transaction profits and losses according to the amount of money traded. If you are over-leveraged, this can kill you. Forex trades are quoted in ‘LOTS’. There are various ways that forex is calculated but we will look at the easiest example where the USD is on the RIGHT side of the forex pair. In these scenarios, the prices will ALWAYS be the same:

- 1 Micro Lot = $0.10 per pip (remember the 4th decimal point) and is worth $1,000 in real money

- 1 Mini-lot = $1 per pips and is worth $10,000 in real money

- 1 Standard Lot = $10 per pip and is worth $100,000 in real money

Now let’s assume you open a $1,000 account and trade with zero leverage at 10 cents per pip. The market would have to move a whopping 10,000 pips against you, in order for you to lose your account or get margin called. (A margin call is when a broker ‘calls away’ your trade or closes your trade before they are on the hook for any losses. In rare instances, a margin call can result in you owing your broker money but they usually close your trade well before that point.

So if you are trading with zero leverage, or trading only $1,000 of real money; the same amount that is in your account, you are trading safe. Your profits will not be nearly as high as if you are using leverage, but you will be relatively safe.

Now let’s look at Mr. Bad Ass Playboy who wants to get greedy and Make ALL Da Loot! Let’s say he opens a $1,000 account and leverages 1,000:1 (controls $1,000 for every $1 in his account). He trades 10 standard lots and price only has to move 100 pips to wipe him out. 100 pip moves happen every day in forex so if he uses 1000:1 leverage, he WILL lose all his money.

This is why the shady overseas brokers that are not regulated allow traders to use 1000:1 leverage. They know that the larger the trader trades, the more likely he will lose and if the broker is acting as the counter party to your trades, he will laugh all the way to the bank while you cry and hold a gun to your head.

THE PROPER WAY TO — USE LEVERAGE

I use a maximum of 5:1 leverage. Here is why. By compounding profits, your account can grow very, very fast and you will not risk losing your account in one trade. Maybe the profits are not a big and wonderful as Mr. Bad Ass Playboy but guess what? You will be in this industry long after he blows out his accounts and is working at McDonalds.

Leverage is a double edge sword. Use it properly and you can slay your enemy. Swing too hard and the sword will come all the way around and slice your own neck.

#9 above just tells you the time it is. It doesn’t matter in the quote.