I love reading other peoples technical analysis of charts, because more often than not it's pure speculation (in other words 100% horseshit).

The amazing thing is, everyone pretty much gets taught the same thing, what patterns to look for and how to trade them. As I mentioned in another post, they never stop to think about who is teaching them, or why, and it's usually because that person has a conflict of interest, ie, they stand to make money when you lose.

Humans have evolved over millions of years as pattern recognition machines, which is why most people looking at two dots and a curve see a smiling face...

The problem with chart patterns for technical analysis, is once you know a few of the patterns you begin see them everywhere.

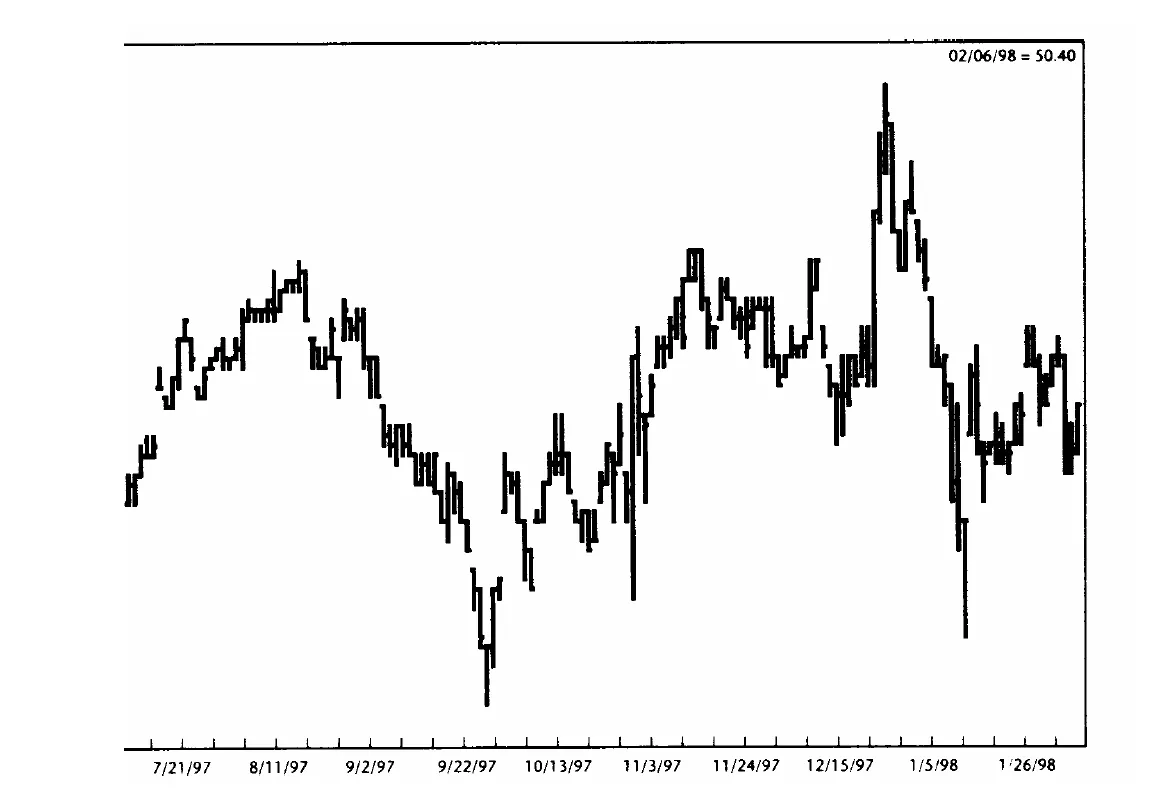

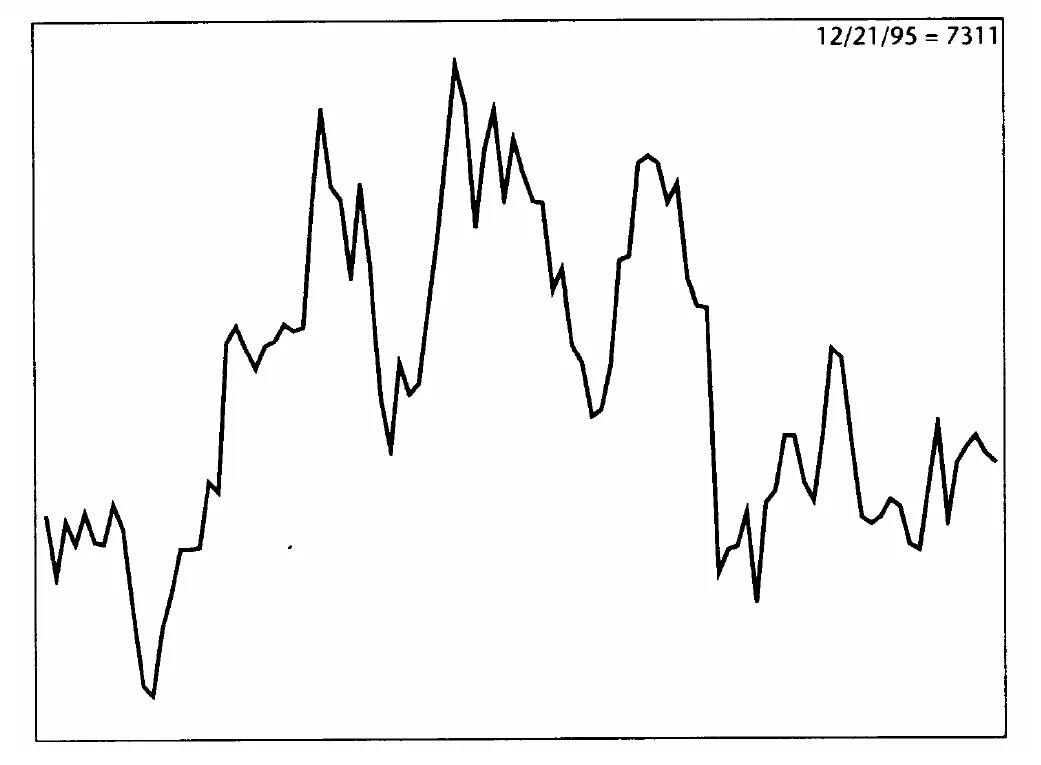

Take the following bar chart for example, with highs, lows and close.

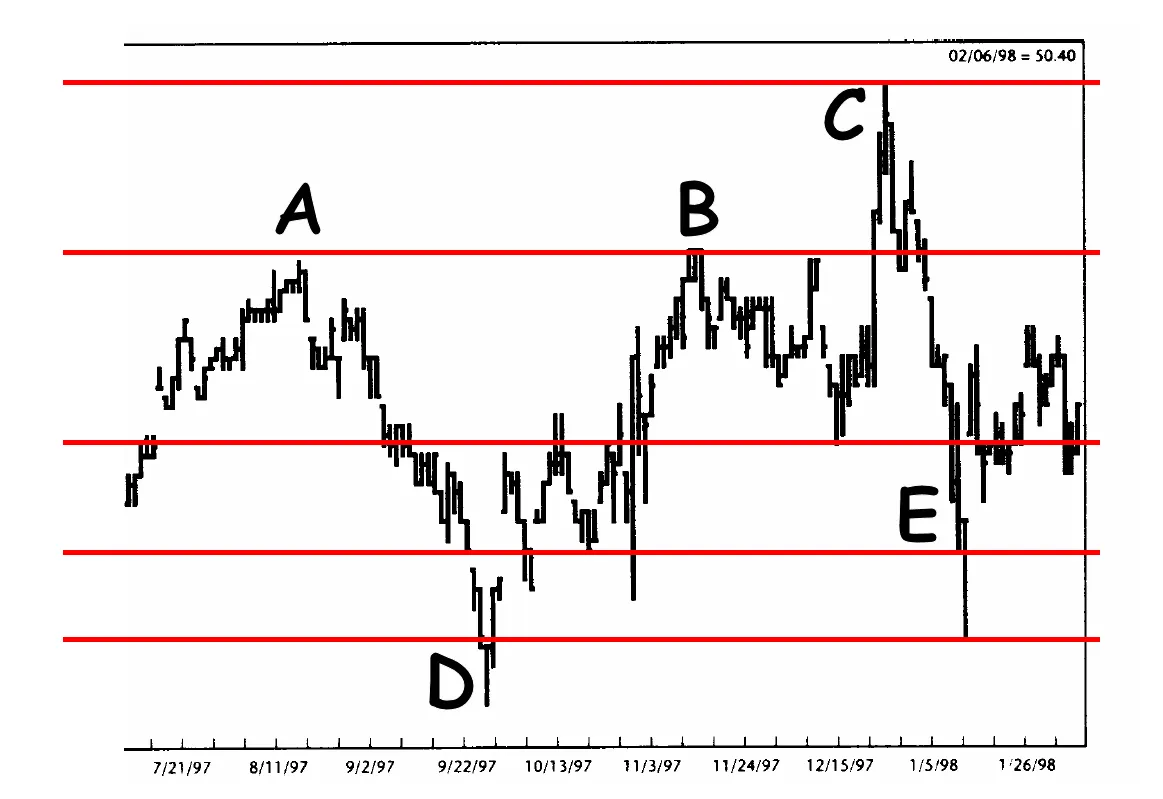

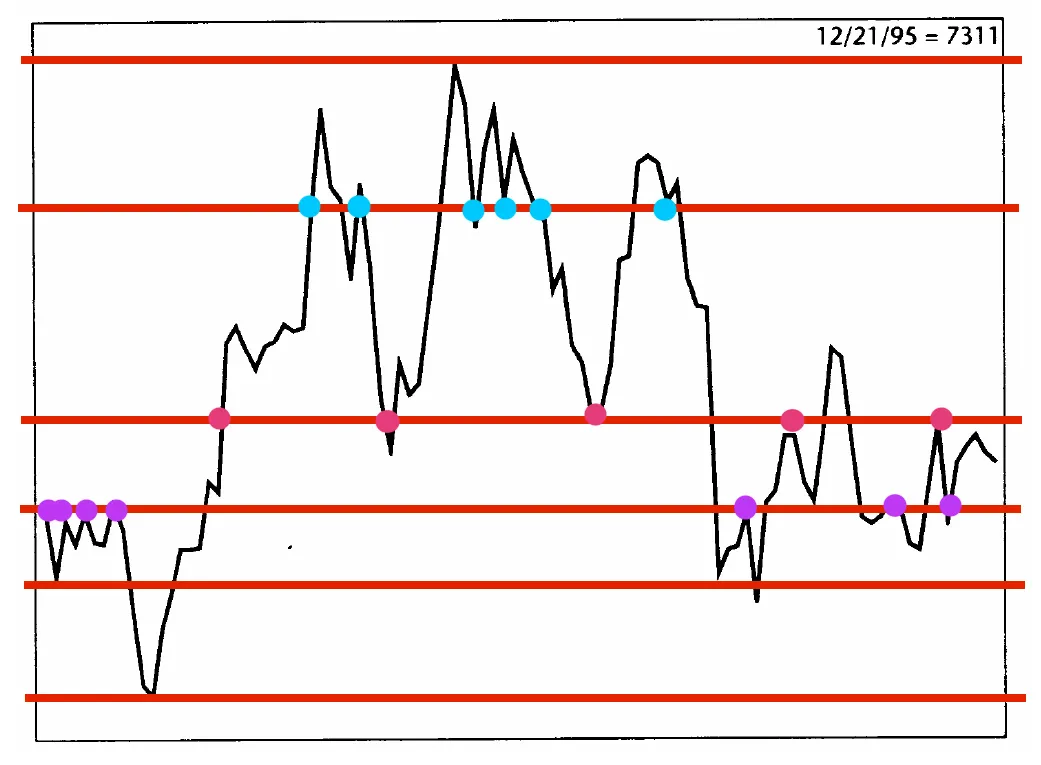

Lets see what would happen if you gave it to a technical analyst for their opinion. First of all we'll draw some support and resistance lines, which are fairly obvious.

You can see that the market made an initial top around point A, and then again at point B, and once more a few weeks laters, thus confirming an important resistance line. The price finally broke though and made a new high at point C before quickly retracing into a sustained downtrend. This ended in a long pinbar/hammer which indicated the price would soon start recovering, which it did. Notice also the gap down and pinbar at point D, signifying the buyers coming into the market at the extreme low.

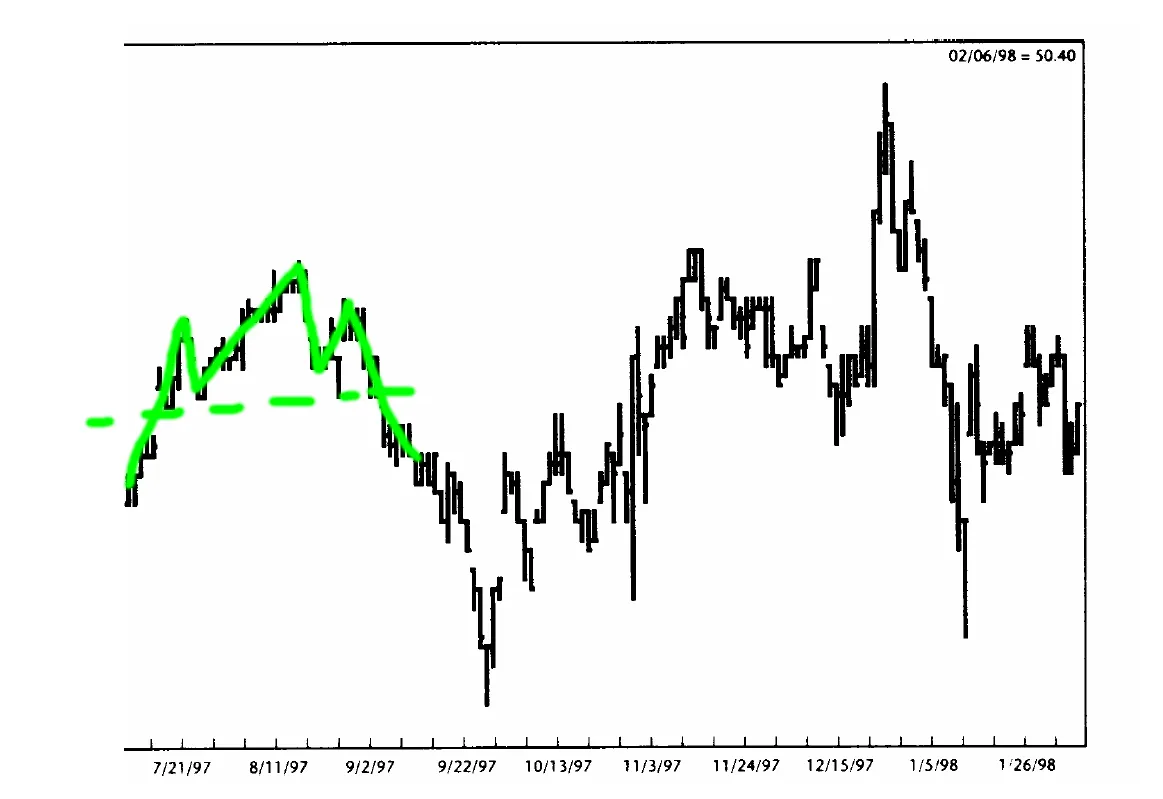

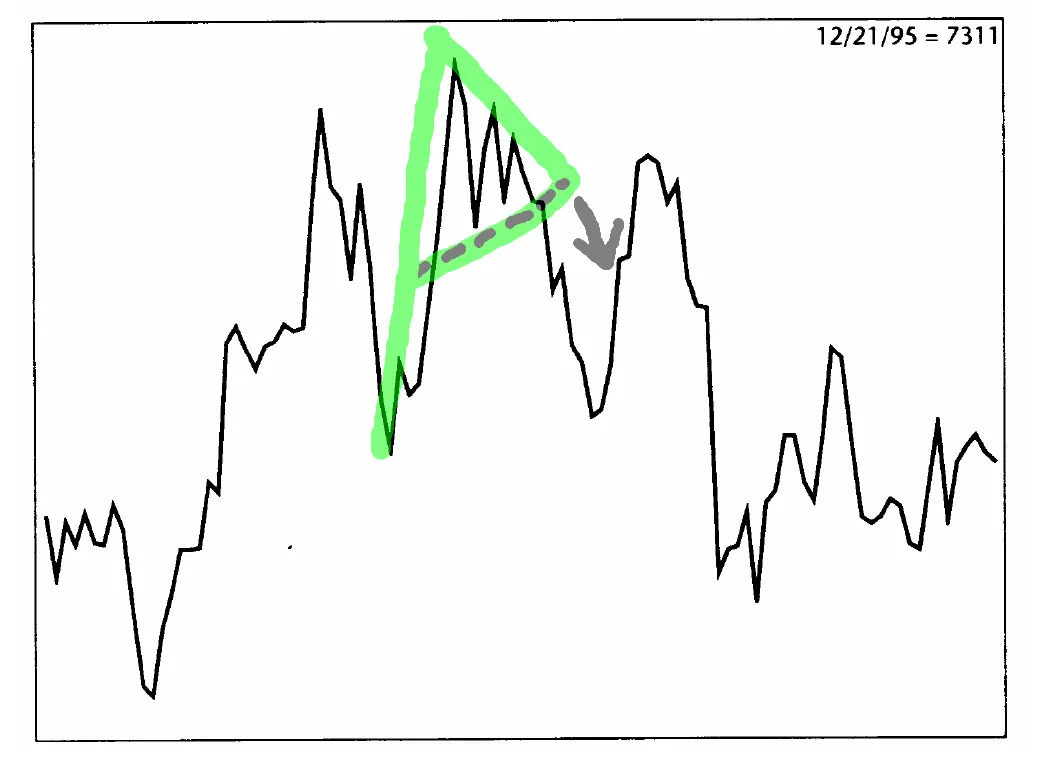

Lets see what other technical analysis we could do on this chart. You can see that the initial stage of the chart was a setting up of a classic head and shoulders pattern, prior to that long downtrend, even the most incompetent trader could have seen that coming !

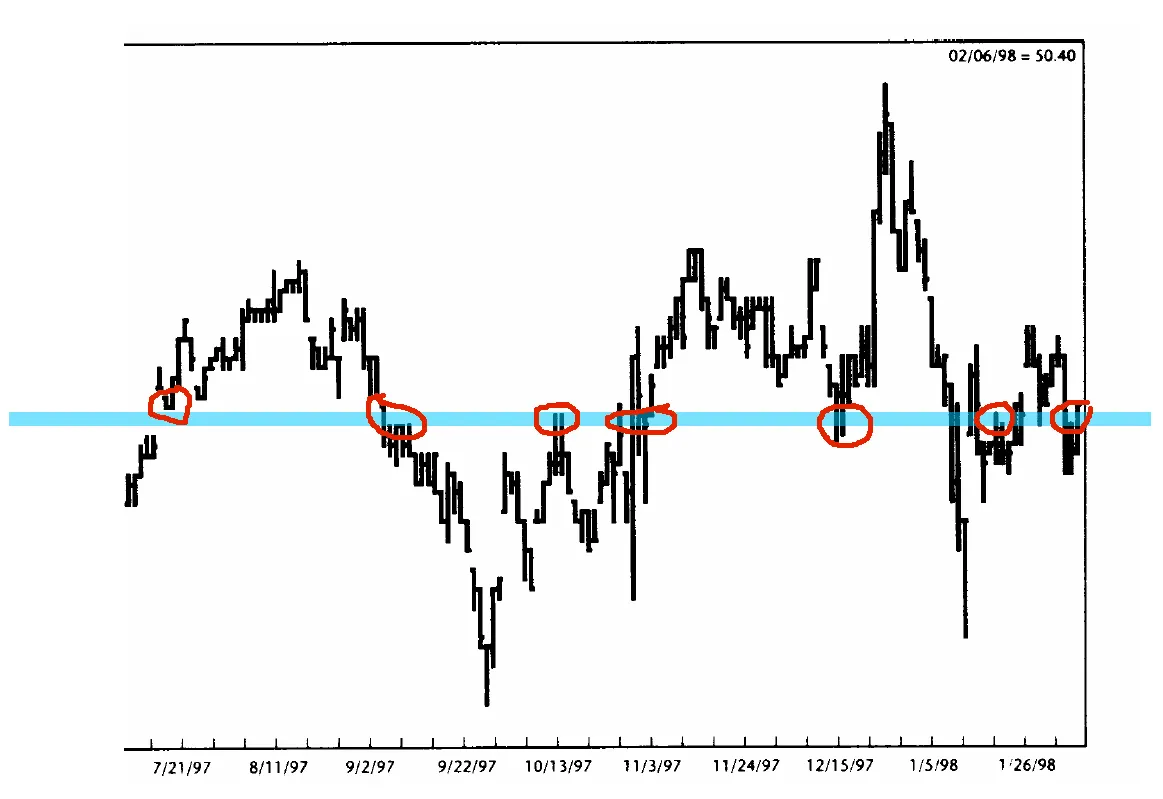

The stand out point on this chart for me though, is that support/resistance line in the middle. Look how many times it was tested and rejected, then broken, then bounced back. It would result in high probability trades if you were to keep an eye on that line and enter trades around it.

I could go on an on about other aspects of the chart and other patterns on it for ever, but there's no point because it's all horseshit. That isn't even a stock chart, it an annual temperature chart... It has absolutely nothing to do with trading, there are no buyers, no sellers, no market pressures, just the range of temperatures on days throughout the year.

See how easy it is to make stuff up and have people believe you ? See how easy it is to get sucked into seeing patterns that don't exist, or at least don't have any significance whatsoever ? Take any chart of data, showing literally anything with ranges, and you can lay stock patterns over them all day long.

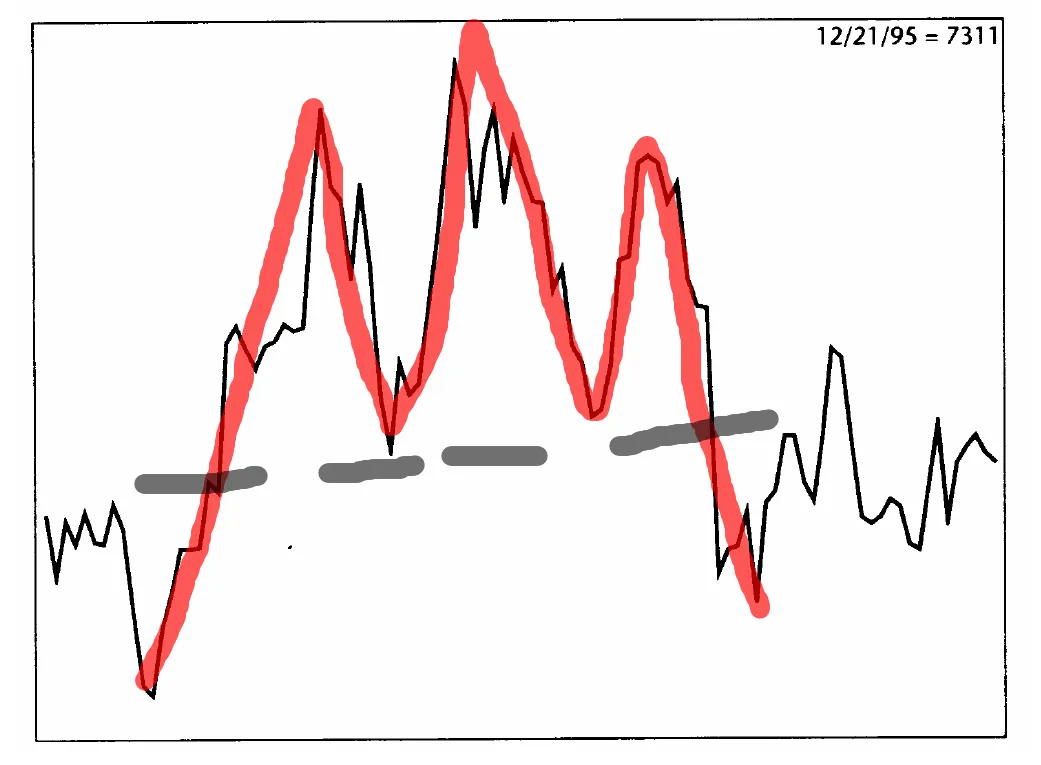

Don't believe me ? How about this chart then.

I'll draw a few support and resistance lines on it.

See how the price touched those lines on multiple occasions and where it got rejected ? Or how about this triangle/flag/pennant pattern here and the breakout to the downside ?

Or how about the fact the whole thing is a head and shoulders pattern ?

Nope, it's still all horseshit. That chart is literally the result of tossing a coin in the air, 150 times (accumulatively). Still no traders, no stocks, no pressures, just the random result of a 50/50 outcome.

So my advice is, be very very wary of people performing technical analysis of charts, and there are a metric shit-ton of them here on Steemit. I'll guarantee that the majority haven't got a clue what their talking about, so you would be very stupid indeed if you risked any of your own money on anything they had to say.

As a final note, please don't think that I consider all technical analysis to be bunk, as I don't. I would consider myself a technical trader after all ! The problem is you need to understand how technical indicators are formed, and the psychology of them, and the underlying monetary forces that make them happen in order to use them successfully.

Just drawing a handful of lines on a chart and making pronouncements about how the price is going to 'obey' them is pure hokum.

Disclaimer : If you blindly act on the advice of strangers from the internet then you're an idiot and probably deserve to lose all your money. There's no fast track to success. Do your own research and make informed decisions based on all available evidence.