- Bitcoin Price Fighting to Close Week Above Key $7,200 Resistance Level;

- Why This Global Crisis Is a Defining Moment for Stablecoins ;

- $166B Asset Manager Renaissance Eyes Bitcoin Futures for Flagship Fund;

- Data Suggests Some Americans May Be Buying Crypto With Stimulus Check ;

- Weekend Attack Drains Decentralized Protocol dForce of $25M in Crypto;

- 🗞 Daily Crypto Calendar, April, 20th 💰

- Bitcoin Trading Update

Welcome to the Daily Crypto News: A complete Press Review, Coin Calendar and Trading Analysis. Enjoy!

🗞 Bitcoin Price Fighting to Close Week Above Key $7,200 Resistance Level

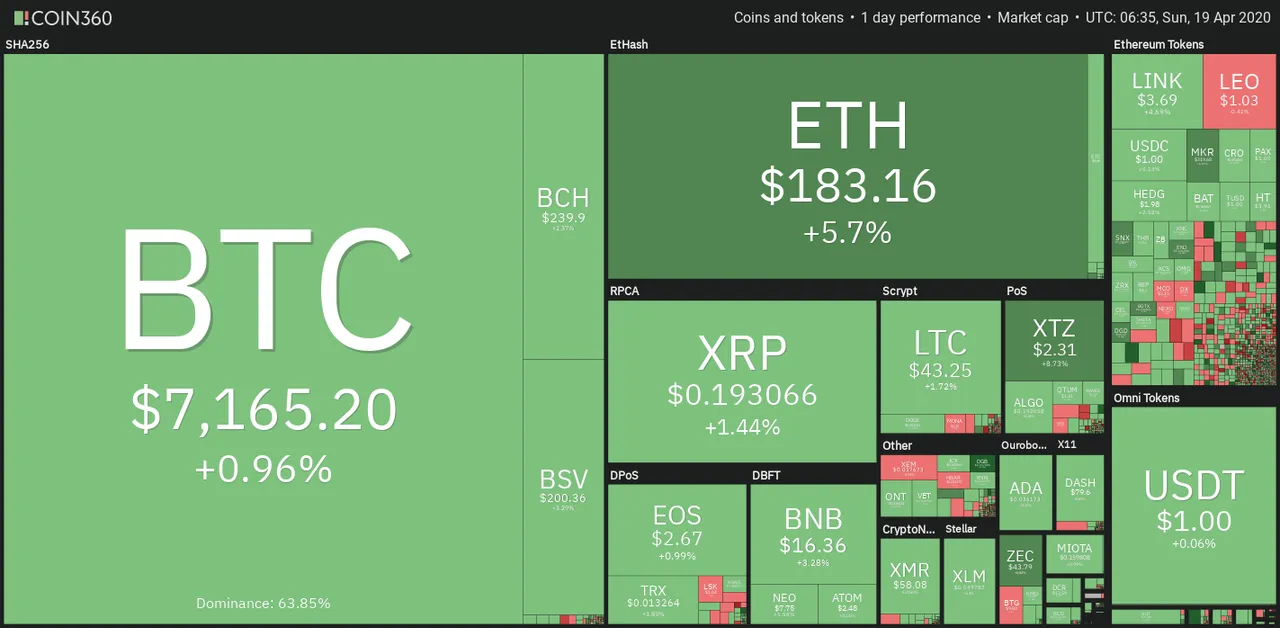

Bitcoin price surged within a few dollars reach of $7,300 before cooling off near the $7,100 support, meaning traders will be keeping a close eye on today’s weekly close.

On Saturday Bitcoin (BTC) price punched a hole through the $7,200 resistance, rallying all the way to $7,293 to briefly escape the resistance cluster the price has been trapped within since April 6.

As the Bitcoin price surged on Saturday, altcoins also added commendable gains. Ether (ETH) rallied to $189.60 before pulling back to trade at $182.50. Chainlink (LINK) pushed to $3.82 and at the time of writing trades for $3.70 while Tezos (XTZ) surged to 12% to $2.37 before dropping to $2.23 in the last hour.

The overall cryptocurrency market cap now stands at $208.4 billion and Bitcoin’s dominance rate is 63.4%.

🗞 Why This Global Crisis Is a Defining Moment for Stablecoins

Marek Olszewski is cofounder of cLabs, working on Celo, a mobile-first permissionless platform that makes financial tools accessible to anyone with a mobile phone.

Stablecoins emerged in 2018 with exciting promises of being used across the globe to improve financial access and help countries plagued by hyperinflation or cross-border payments and remittance friction/headaches. In practice, they were primarily used to shield traders from the wild volatility of early crypto markets and for arbitrage.

The global crisis brought on by COVID-19 is an opportunity for stablecoins to deliver on these promises and use cases, especially as governments try to deliver stimulus money quickly to large populations that desperately need it. The global economic and health crisis has reinvigorated the use of stablecoins, as well as the discussion of digital dollars and central bank digital currencies. With close to 6 billion smartphones with active mobile subscriptions in the world, we are nearing a reality where an easy-to-use stablecoin can reach a significant portion of the world’s population.

🗞 $166B Asset Manager Renaissance Eyes Bitcoin Futures for Flagship Fund

Renaissance Technologies’ market-crushing Medallion fund is considering jumping into bitcoin futures, recent regulatory filings show.

The quantitative analysis-heavy firm has “permitted” the Medallion fund to enter the Chicago Mercantile Exchange’s (CME) cash-settled bitcoin futures market, according to the March 30-dated Form ADV investor brochure.

Renaissance, which had nearly $166 billion in regulatory assets under management at the end of 2019 according to that filing, has effectively signaled that bitcoin could or already is a factor for its flagship Medallion fund, whose 66 percent average pre-fee annual return since 1988 is unmatched on Wall Street.

🗞 Data Suggests Some Americans May Be Buying Crypto With Stimulus Check

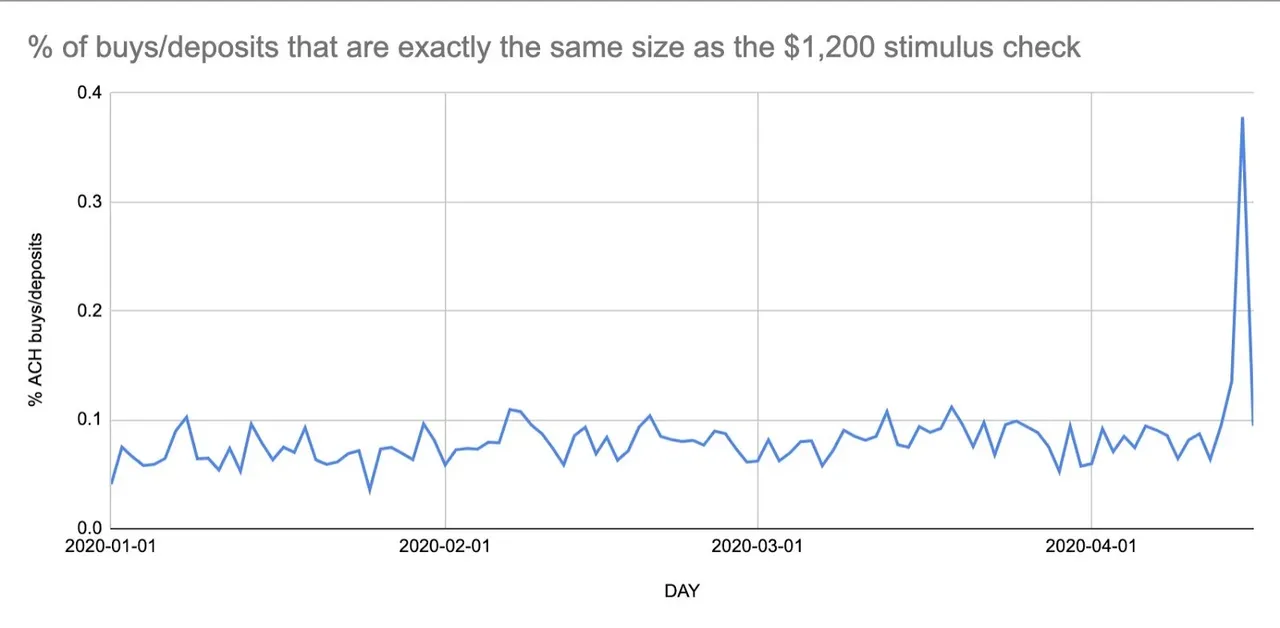

A chart published by Brian Armstrong, CEO of United States crypto exchange, Coinbase, suggests that a small portion of the American population may be using their coronavirus stimulus checks to purchase cryptocurrency.

A tweet, published by Armstrong on April 17, shows that the percentage of deposits and buys worth $1,200 — the exact value of the stimulus check — recently increased over four times. While the tweet does not explicitly state so, Armstrong’s position at Coinbase may suggest that this is the exchange where the data comes from.

🗞 Weekend Attack Drains Decentralized Protocol dForce of $25M in Crypto

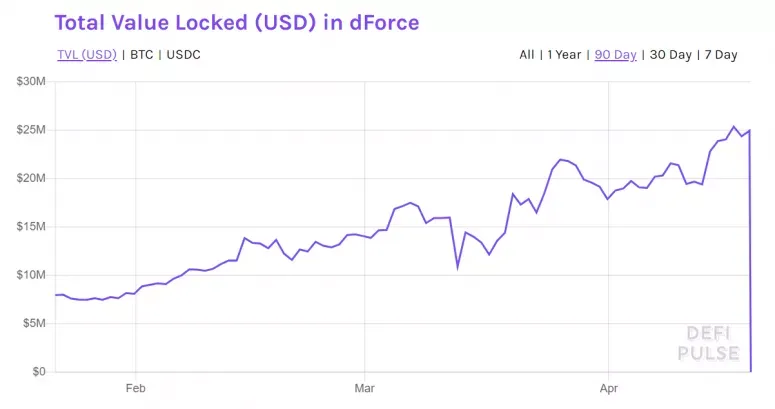

Decentralized finance protocol dForce has lost over 99 percent of its assets in an attack Saturday night, according to DeFi Pulse.

Lending protocol Lendf.me saw some $25 million in ether (ETH) and bitcoin (BTC) exit its wallets late Saturday and early Sunday after its money market pool was attacked. Lendf is one of two protocols supported by the dForce Foundation.

“Lendf.me confirmed it was attacked at 8:45 Beijing time Sunday at block height 9899681,” Lendf.me said to Chinese media outlet Chain News. dForce did not respond to CoinDesk's requests for comment by press time.

🗞 Daily Crypto News, April, 20th💰

- SINOVATE (SIN)

SINOVATE Webtool Release on 4/20/2020.

- CryptoAds Marketplace (CRAD)

CryptoAds Marketplace with Persian support will launch on April 20.

- IOST (IOST)

Bithumb Official launches staking as a service with IOST as first cryptocurrency available for staking.

- Azbit (AZ)

"9th weekly burn: 66,078,198.58 native coins were irrevocably destroyed."

Bitcoin Trading Update by my friend @cryptopassion

Here is the chart of my last analysis :

Here is the current chart :

It looks like the market is really interested to test and try to break the resistance line at 7330$ very soon. The break of that resistance line would be a very bullish sign as it would signify that the market want earse the big correction that we experienced in March. Till now, we have not been able to break that resistance line in the past, let's see if the market will be more powerfull this time.

Last Updates

- 🗞 Daily Crypto News, April, 18th💰

- 🗞 Daily Crypto News, April, 17th💰

- 🗞 Daily Crypto News, April, 16th💰

- 🗞 Daily Crypto News, April, 15th💰

- 🗞 Daily Crypto News, April, 14th💰

- 🗞 Daily Crypto News, April, 12th💰

- 🗞 Daily Crypto News, April, 11th💰

- 🗞 Daily Crypto News, April, 10th💰

- 🗞 Daily Crypto News, April, 9th💰

- 🗞 Daily Crypto News, April, 8th💰

- 🗞 Daily Crypto News, April, 7th💰

- 🗞 Daily Crypto News, April, 6th💰

- 🗞 Daily Crypto News, April, 5th💰

- 🗞 Daily Crypto News, April, 4th💰

- 🗞 Daily Crypto News, April, 3rd💰

- 🗞 Daily Crypto News, April, 2nd💰

- 🗞 Daily Crypto News, April, 1st💰

You don't want to miss a Crypto news?

Follow me on Twitter or Facebook

Come try out a great blockchain game: Splinterlands