- 3 Reasons Why Bitcoin Price Could Crash if US Stock Market Collapses;

- Ethereum's $5.2 Million Fee Scandal Explained: Exchange Held to Ransom by Hackers;

- These Are 8 Biggest Crypto Funds According to a New Database;

- Not So Private: 99% of Zcash and Dash Transactions Traceable, Says Chainalysis;

- Tezos and Algorand Latest to Integrate Tech for Anti-Money Laundering Compliance;

- 🗞 Daily Crypto Calendar, June, 13th 💰

Welcome to the Daily Crypto News: A complete Press Review, Coin Calendar and Trading Analysis. Enjoy!

🗞 3 Reasons Why Bitcoin Price Could Crash if US Stock Market Collapses

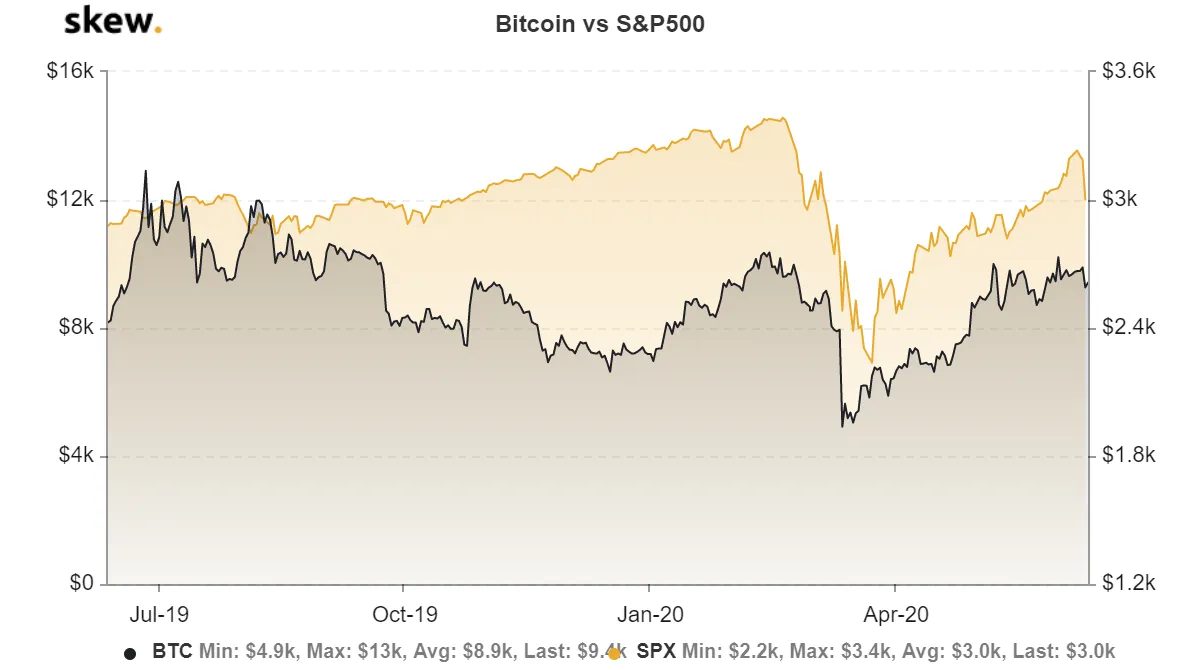

Experts in the financial market and the crypto industry foresee a major stock market correction unfolding in the short term. Given the high correlation of Bitcoin (BTC) with stocks observed in the past three months, there is a strong possibility that Bitcoin could follow suit.

The United States stock market has seen extreme volatility after the Dow Jones Industrial Average dropped by around 7% on June 11, led by double-digit drops of airline stocks. A confluence of three factors is seemingly triggering sizable volatility in the stock market: uncertainty around the COVID-19 pandemic, institutions moving to cash and bonds over stocks, and major geopolitical risks.

🗞 Ethereum's $5.2 Million Fee Scandal Explained: Exchange Held to Ransom by Hackers

Hackers are holding an unnamed crypto exchange to ransom after an alleged cyber-attack forced the Ethereum blockchain to facilitate two separate transactions at a cost of $5.2 million in fees, new information suggests.

The hackers may have gained access to the exchange’s funds but failed to transfer the money into their own wallets because of a security setting that demands multiple passwords to process a transaction.

Now they have turned to blackmail, trying to arm-twist the concerned platform into paying a ransom, according to Ethereum (ETH) co-founder Vitalik Buterin.

Explaining the suspicious transactions, Buterin tweeted on June 12 that: “Hackers captured partial access to exchange key; they can’t withdraw but can send no-effect txs with any gas price. So they threaten to ‘burn’ all funds via tx fees unless compensated.”

🗞 These Are 8 Biggest Crypto Funds According to a New Database

There are eight crypto funds with more than USD 250 million in assets under management (AUM), according to the newly-launched Dove Mountain Data, a live database of all funds deploying capital into crypto.

This free, live database was created by Regan Bozman, Director Of Business Operations at CoinList, a token listing platform backed by Twitter CEO Jack Dorsey.

In a blog post this week, Bozman said that the goal of this project is "to make fundraising in the space more transparent." He argued that "for an industry that hypes openness, fundraising remains an opaque process and many funds choose to operate under the radar. There are valid reasons for funds doing so, but nonetheless, it makes entrepreneurs' lives harder."

🗞 Not So Private: 99% of Zcash and Dash Transactions Traceable, Says Chainalysis

Chainalysis says it can track 99% of transactions involving Zcash, and almost all of Dash’s – coins that both fancy themselves as private and untraceable.

Now, that’s because the majority of users do not utilize the optional privacy-enhancing features available on the two blockchains, it said in a June 8 blog, announcing support for the two cryptocurrencies.

By tracking the privacy coins – digital assets whose primary purpose is to hide financial transactions from unwanted attention – Chainalysis has made it easy for law enforcement agencies to do the same.

“Dash and Zcash allow users to conduct transactions with greater privacy, but that doesn’t mean they provide total anonymity,” asserted the U.S.-based crypto analysis company.

🗞 Tezos and Algorand Latest to Integrate Tech for Anti-Money Laundering Compliance

Two blockchain platforms, both proof-of-stake, are trying to stay on the right side of the Financial Action Task Force’s (FATF) “Travel Rule.”

In separate announcements on Thursday, the Algorand and Tezos Foundations said they had linked up with two analytics companies, Chainalysis and Coinfirm, respectively, to help bake regulatory compliance into their eponymous blockchains.

It’s been very nearly a year since the Financial Action Task Force (FATF), the global anti-money laundering (AML) watchdog, updated its guidance for nations to stipulate that crypto companies must store and disclose information about senders and receivers, above a certain transaction threshold.

🗞 Daily Crypto News, June, 13th💰

- Eidoo (EDO)

"The amount to be burnt is 28,350,000 EDO tokens."

- Monero (XMR)

"The Monero Konferenco is an annual meeting of privacy advocates, cypherpunks, scientists, and philosophers."

- Ergo (ERG)

"We're hosting an AMA with Ergo (ERG) this Saturday, June 13th at 16:00 UTC. Join us on Telegram. gainschat.@.

- HollyWoodCoin (HWC)

"#HWC (@Hollywood_Coin) currency will be delisted from Crex24 on 13.06.20... Trade will stop on 06.06.20."

Last Updates

- 🗞 Daily Crypto News, June, 12th💰

- 🗞 Daily Crypto News, June, 11th💰

- 🗞 Daily Crypto News, June, 10th💰

- 🗞 Daily Crypto News, June, 9th💰

- 🗞 Daily Crypto News, June, 8th💰

- 🗞 Daily Crypto News, June, 7th💰

- 🗞 Daily Crypto News, June, 6th💰

- 🗞 Daily Crypto News, June, 5th💰

- 🗞 Daily Crypto News, June, 4th💰

- 🗞 Daily Crypto News, June, 3rd💰

- 🗞 Daily Crypto News, June, 2nd💰

- 🗞 Daily Crypto News, June, 1st💰

- 🗞 Daily Crypto News, May, 31st💰

- 🗞 Daily Crypto News, May, 30th💰

- 🗞 Daily Crypto News, May, 29th💰

- 🗞 Daily Crypto News, May, 28th💰

➡️ Publish0x

➡️ UpTrennd

➡️ Minds

➡️ Hive

➡️ Twitter

➡️ Facebook

➡️ Be paid daily to browse with Brave Internet Browser

Proud member of: