Last week, we saw a sharp rise in long-term interest rates, causing panic in the US debt markets. After Trump announced sweeping tariffs on nearly the entire world, the 10-year yield rose to 4.5% and the 30-year topped 5%, meaning that both notes and bonds were being sold off.

There was talk that the spiking yields could have been the result of the basis trade unwinding, or foreign entities like China selling their US debt. Unfortunately, with the bond market being a black box, we commoners cannot pinpoint the exact cause.

After a tumultuous week, the financial markets calmed down a bit today, and interest rates fell. In addition to some tariff exemptions on electronics, this may have something to do with a reassuring statement from Scott Bessent, the new secretary of the United States Treasury Department.

The Treasury's Toolkit

In reference to last week's unraveling of the bond market, Bessent said in a Bloomberg interview today (timestamp 15:15) that "we have a big toolkit", and that includes boosting bond buybacks, a stabilization program that has been in effect since last year.

But hold on a minute...

If the US government already owes $37 trillion dollars, how are they going to buyback their own bonds?

No one wants to hear the words "quantitative easing" (QE) or "bailouts" again. These terms have already been used on previous occasions when market intervention was required, and all they did was save the rich while causing economic stagnation and inflation for everyone else.

Therefore, the Treasury has to come up with some new "Non-QE" vocabulary like "bond buybacks" to describe what needs to be done (which is essentially inject more liquidity into the banking system) in order to stabilize the US debt markets.

With that said, what methods can the Treasury use to buyback their own debt?

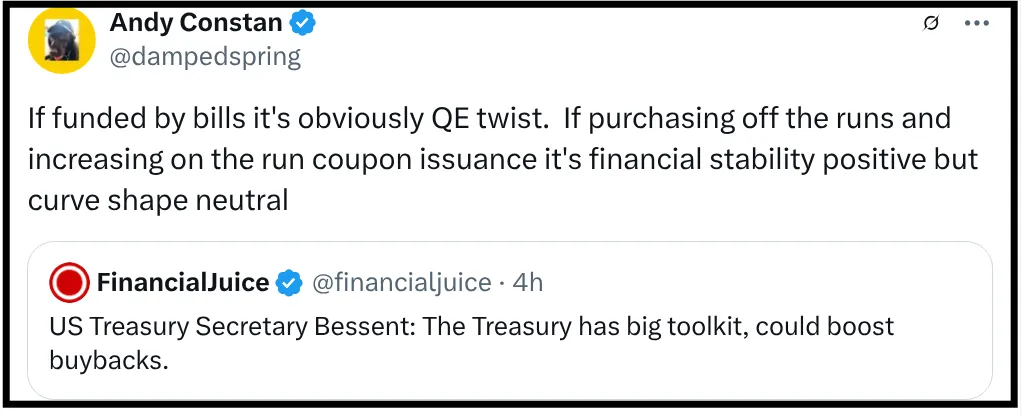

- QE Twist. The Treasury could issue more liquid short-term debt (bills) in order to buyback the illiquid longer-term debt (bonds). Andy Constan pointed out on X that this would essentially be QE twist, only that the Treasury would be doing it instead of the Federal Reserve.

- Buying "off-the-runs". The Treasury could also repurchase less liquid older bonds (e.g. a 10-year note issued two years ago) and issue new "on-the-run" bonds, which would be more actively traded and liquid.

- Taxes. The US government could also buyback bonds using tax revenue. That would be an impressive feat though, considering that they have a (projected) deficit of $2 trillion dollars for 2025. DOGE would have to cut substantially more spending!

In any case, bond buybacks by the treasury would increase liquidity in the banking system, and probably send Bitcoin along with other cryptocurrencies higher, even if the intervention scares the market temporarily.

Focusing On The Long-Term Solution

It's becoming increasingly clear that the financial system is serving the incumbent players, while making life harder for the newcomers. Unfortunately, these financial stresses are causing tensions to rise between the older and younger generations.

What is the long-term solution here?

Compared to the bond market, cryptocurrencies like Bitcoin and Ethereum are far more transparent, allowing us to pinpoint any issues that may be negatively impacting the system. Moreover, cryptocurrencies are not based on unsustainable debt, and do not require an exponentially growing economy to retain value.

Although prices are down, in the long-run crypto is a lifeline for anyone who doesn't want to get caught up in the mess of the debt-based financial world. Millennials and Gen Z, many of whom have lost hope in the existing system, can shift their attention to this new technology, and help build-out a sustainable economy for future generations.

Until next time...

If you learned something new from this article, be sure to check out my other posts on crypto and finance here on the Hive blockchain. You can also follow me on InLeo for more frequent updates.

Further Reading

- Bond Market Still Stressed Despite Pause On Tariffs

- Who Does The World Owe $315 Trillion Dollars To?

- Why Censorship-Resistant Blockchains With Economic Activity Will Be The Most Valuable Long-Term