Mind you, I was hit with constant ridicule when I tried to get others interested in cryptocurrency. No one else could see that this represented the future. People thought I was crazy for investing in a more powerful computer in order to mine faster. Heck, you could even mine on a laptop. I'd often leave my comp running while I was gone and then waited for that new tower to arrive.

And that's when the you know what, hit the fan.

Missing in action

As now, UPS and FedEx would just leave expensive electronics sitting on the front steps. Which is what happened to my new system. It sat on the steps for FIVE AND A HALF HOURS... Anyone could have just picked it up along with my costly new video card, since the company logo was visible from the street. So, I come home take the boxes upstairs and see a blank spot where my old computer was...

What the hell happened!

Turns out, an older person with no knowledge of technology, decided to "help me out" by "getting rid of that old thing" to make room for my new machine. I wasn't too worried as the BTC was only worth $25. Of course anything resembling a paper wallet was taped underneath my monitor, and that along with the tower was handed off to the garbageman. I even called them, but by then everything had already been dumped at the landfill.

Mind you, I was more concerned about the uh, "research photos" I'd lost than the cryptocurrency that could have just bought me a nice large pizza and soda. In fact, it hadn't been long since that famous first purchase was made for roughly 10,000 BTC. So who was I to worry about a measly 25, right? It's only when I think what they'd be worth today, that it gives me pause.

See, I thought I'd taken all of the proper precautions. Paper backup? Check, but I only made one copy, taped underneath my monitor when they were both thrown out. Emailed a copy to myself? Check, but neglected to log in after awhile and they shut my account down, then went out of business. Everything that could go wrong, did. This all taught me valuable lessons, one of them being: have a backup to the backup and don't trust email providers, they come and go.

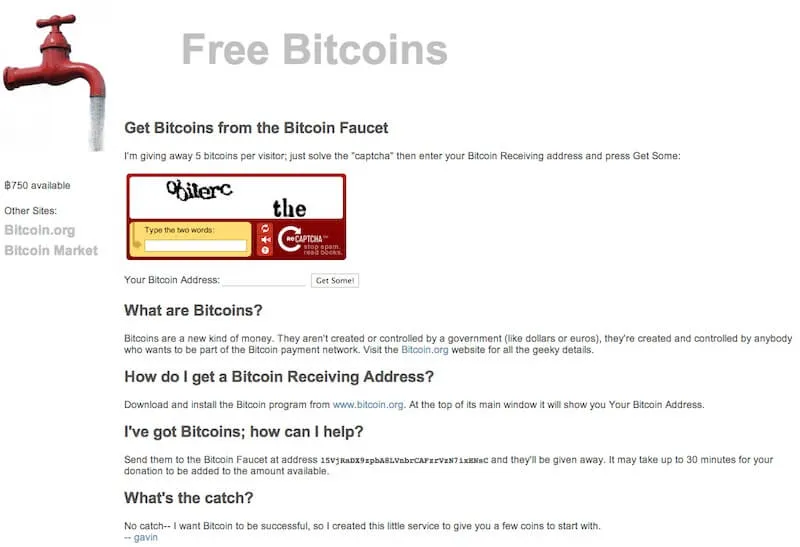

So I started mining and visiting faucets again and this time I decided to use an online service. I'm sure you've all heard of MtGox? then you know what happened to the rest of my Bitcoin... After that, I decided to step back until the security situation improved. Life took over, but I still kept an eye on developments in the world of crypto. In spring/summer 2016, I saw the first message of some dude making $1000 from a blog post on a website called Steemit. Not wanting to be burned again, I thought "scam" and deleted it, thus losing my chance to become an early whale. The next year, I finally joined. Seeing all of the wild price swings (remember late 2017?) with STEEM and alts, Bitcoin, Hive and Leo, has given me a perspective I never would have had otherwise.

Learning and growing

There is no such thing as permanently missing out. Yes, you may see one wave roll by, but there will always be another one. The important thing is: be ready to ride. During most of that time, money was tight. But it taught me the vital importance of having something on hand in order to pounce on those opportunities when the time arrives. Look at the price of LEO six months ago compared to where it is now. I read here just recently that for roughly $200 one could have become a whale on LeoFinance. I've learned to do your due diligence, then be ready to act on it, which is why I bought my first LEO miners months ago. Watching that low price, took me back to 2009 when Bitcoin was new. I thought, "if I make a small investment and it goes bust, I won't have lost much. But if I sit on my hands and do nothing..." I clicked the button and joined the Pride.

The lesson is, as in life, you have to be willing to take a calculated risk and support something you love. The old, is being peeled away like the skin of an onion, revealing something new. Asking that girl out is a risk. Buying that new home. Relocating for that new job is also a roll of the dice. Right now, I own shares in a weed stock that has been pummeled due to the pandemic. And while this isn't financial advice, I'm using a mix of dollar-cost averaging and lump sum investing, because I believe we will get through this. It's a young industry, with the potential for explosive growth. Just like crypto and LeoFinance.

So the takeaway is to take nothing for granted. That while the road ahead may be bumpy from time to time, If you take the long view, you can weather the storm. Losing those Bitcoin taught me to prepare for the pitfalls in life and to be ready when opportunity knocks at my door.

Thank You So Much!

Please follow me on:

👍Twitter: https://twitter.com/EverNoticeThat

👍Earn Crypto with Brave Browser: https://brave.com/eve641

👍Instagram: https://www.instagram.com/evernoticethat/

👍Hive: @evernoticethat