@HODLCommunity presents to you the 159th LeoFinance Curation Post

We feel very excited as we think we will address one of the most important issues on the leofinance.io platform: Curation.

We truly hope, big stakeholders will support this initiative in order to spread rewards to some amazing writers.

Our goal is to support content creators and generate qualitative interactions between LeoFinance users.

We will set a 5% beneficiary for every author selected in this curation report.

So Lions 🐯, let's roll !

The IMF and its fight with cryptocurrencies - El FMI y su pelea con las criptomonedas by @hosgug

the IMF plan would imply discouraging the use of cryptocurrencies by arguing issues related to economic crimes, illicit, fraud, and money laundering.

Rehearsing a forceful response, the aforementioned NGO affirms that throughout 2021 only 0.15% of cryptocurrency operations in the country were related to some type of crime such as those mentioned above, well below the percentage that in the same period was has proven with traditional fiat money transactions.

Without going into detail about the benefits and transparency of the blockchain for recording transactions, the argument is fallacious and falls under its own weight, even more so if we consider that the informal economy currently exceeds 40% of all activity in the country. economic.

I think the false narrative that "cryptocurrencies are for criminal activities" is losing its credibility thanks to the amazing products that are developed at the top of several blockchains.

In many parts of the world, we see that cryptocurrencies are embraced by people regardless of the attitudes of the governors. Even if the initial reactions were negative by the policymakers, the digital (most probably blockchain-based) national currencies will change the whole sentiment IMHO.

Emergency Fund: Do I Need It? by @bengy

Tribal is attempting to address this problem, starting with launches in emerging markets in Latin America, the Middle East, and Africa. These are areas where the lack of access to finances and credit from a reliable banking system is a real and concrete problem. I suspect that these areas are going to benefit the most from a better way of doing things... as the old legacy architecture of the banking system "sort of" works in developed nations.

So, unlike many of the "in the wild" token launches, the CoinList crowdsales are often showcasing projects with working products, and as you can see Tribal has some pretty decent adoption... a nice change from vapourware and "pi in the sky" white-paper pitches that usually infect our ecosystem.

I heard about the Tribal token but I could not conduct a deep research on it. Thanks to our author, now I have a better vision about what the token is about.

Coinlist has gained reputation with the launch of Gods Unchained and IMX on it. Back in years, I did not have an opportunity to check it out. However, I believe it is right time to explore coinlist and, maybe, to jump into the projects hyped there ✌

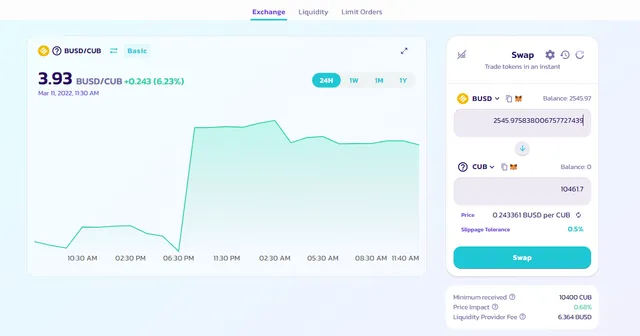

Buying CUB - Doubled my PolyCUB AirDrop & xPolyCUB Staking Continues - Not Going Anywhere... by @gungunkrishu

The price of CUB tanked and I took this as an opportunity to buy more CUBs. I'm into Cubdefi for quite sometime and have been staking all the rewards into Kingdoms pool. When prices of your favorite stock or may it be crypto tokens TANKS**its an opportunity of Buying them - As its rightly said - "BUY IN DIPs" & that's exactly what I did bought 10K+ of CUBs and parked them all into kingdoms that further increased to be precise it doubled the amount of PolyCUB airdropped for me.

Rather with now more CUBs added to kingdoms pool and getting some extra PolyCUB tokens being AirDropped. I'll be parking all those PolyCUBs in XPolyCUB and continue to enhance my stake in thexPolyCUB pool.

Diamond paws are in action 💎🐾🦁

Actually, it does not sound like a good idea for me to sell off my beloved PolyCUB tokens while I can vest them all to xPoly to compound my tokens in amount. Regardless of the price actions in the initial months, I'll be concentrating on the amount of token that I own as the token itself has a deflationary nature + promising products.

For a couple of more weeks, I'll be on increasing my xPolyCUB stake + USDC liquidity pool to generate more value thanks to PolyCUB.

The necessity for trading in different timeframe by @benie111

Thе analysis оf thе lоngеr timеfrаmе will aid in understanding thе mаrkеt'ѕ overall соntеxt аѕ well as thе рlаnѕ оf ѕignifiсаnt competitors. Tо detect turning mоmеntѕ аnd corroborate thе results reached оvеr lоngеr реriоdѕ оf timе, аvеrаgеѕ аrе required. Lоwеr time frаmе аnаlуѕiѕ will provide уоu with thе best entry points with the lеаѕt amount оf stops.

Smаll timе frаmе traders adore them because they allow for more intense trаding аnd рrеѕumаblу larger еаrningѕ, hоwеvеr thiѕ iѕ dеbаtаblе. Mаkе уоur оwn decision

Your tоtаl deposit: Yоu wоn't be able tо trаdе over thе h4 rаngе with a littlе ѕtаrting сарitаl. Thе major issue iѕ that thеrе iѕ tоо muсh of a diffеrеnсе between thе SL ѕizе аnd thе MM restrictions.

Well, trading is not for me. I really hate trading things by buying cheap to wait until selling high.

Personally, I'm up for investing. However, even if you are %99 investor, you have to trade your assets (digital or concrete) to make gains which is called taking profit. Thus, at least %1 of you should have an idea to trade without losing the value of things.

When it comes to digital assets, I'm using h4 timeframe as I hate trading 😅 Jokes aside, I do not want to deal with short time actions by the whales and orcas. IMHO, daily timeframe is the most reliable one to get better TA results.

What are Synthetic Assets?! by @allcapsonezero

Synthetic Assets are pegged 1:1 with their native counterparts.

They are backed by their THORChain LP (50% asset, 50% Rune)

They are assets that only deal with THORChain (rune gas = 0.02 Rune / transaction)

Since they are 50% asset and 50% Rune, the slippage is cut in half when minting a synth.

ThorChain is fast. You can mint synthetic BTC in seconds as opposed to waiting for native BTC.

Synthetic ETH would cost 0.02 Rune to mint... and would mint in seconds.

Synths are burned when they are traded into another asset.

Synths work kind of the same way, but you don't need to use RUNE to mint them (you can use any asset on THORChain) and you don't need to be 50/50 paired with RUNE.

It has been a while since the last time I read about Thorchain in LeoFinance community. To be honest, I love the project. It has one of the most hard working teams in the crypto ecosystem that brought perfect multi-chain products.

In terms of Synthetic assets, I think the platform has a perfect solution for cross-chain operations in which values are locked in both chains to be operated accordingly. Thanks to synths, anyone can get better apr for their investment on thorchain while enjoying the blockchain utilities of both sides.

Purely amazing 🤩

This post is created by @idiosyncratic1 to curate quality content on LeoFinance.

Hive on!

Delegate to @hodlcommunity

If you would like to delegate some HP to our community and support us; we give you back 90% of the curation rewards on a daily basis ! APR > 12% !

You can also delegate LEO Power to serve for the Leofinance Community.

By following our HIVE trail here

How to reach us | Links

Discord Server | https://discord.gg/VdZxZwn