Watching this unfold got me thinking about two key points.

First, contrarians often have a real edge. When the crowd leans heavily in one direction, the chances of an overcorrection—or even outright mispricing—increase. Markets, after all, are emotional ecosystems. Fear and greed don’t play by rational rules, and that creates opportunity for those willing to step back and analyze things through an independent lens. It’s not always comfortable, but playing the other side of consensus often leads to outsized returns when timed well.

Second, it reinforces why momentum trading continues to be such a dominant force. The ability for trends to self-reinforce—especially when everyone is following the same signals—has made momentum strategies a cornerstone in many portfolios. But that’s also where things start to feel fragile.

The rise of ETFs has only accelerated this behavior. With so many passive and index-based products flooding the markets, the idea of crowded trades has become the norm. Entire swaths of investors—retail and institutional alike—are positioned in the same direction. That’s fine when things are going up. But when the tide shifts, the exit gets crowded quickly, and that's when we see the kind of exaggerated moves that can take months of gains off the board in days.

This is the double-edged sword of today’s markets. On one hand, the liquidity and accessibility provided by ETFs and algorithmic trading are impressive. On the other, they’ve shortened market cycles and made reversals more violent. They’ve also amplified the risk of black swan events—those "unknown unknowns" that could catch the entire market flat-footed because everyone was facing the same way.

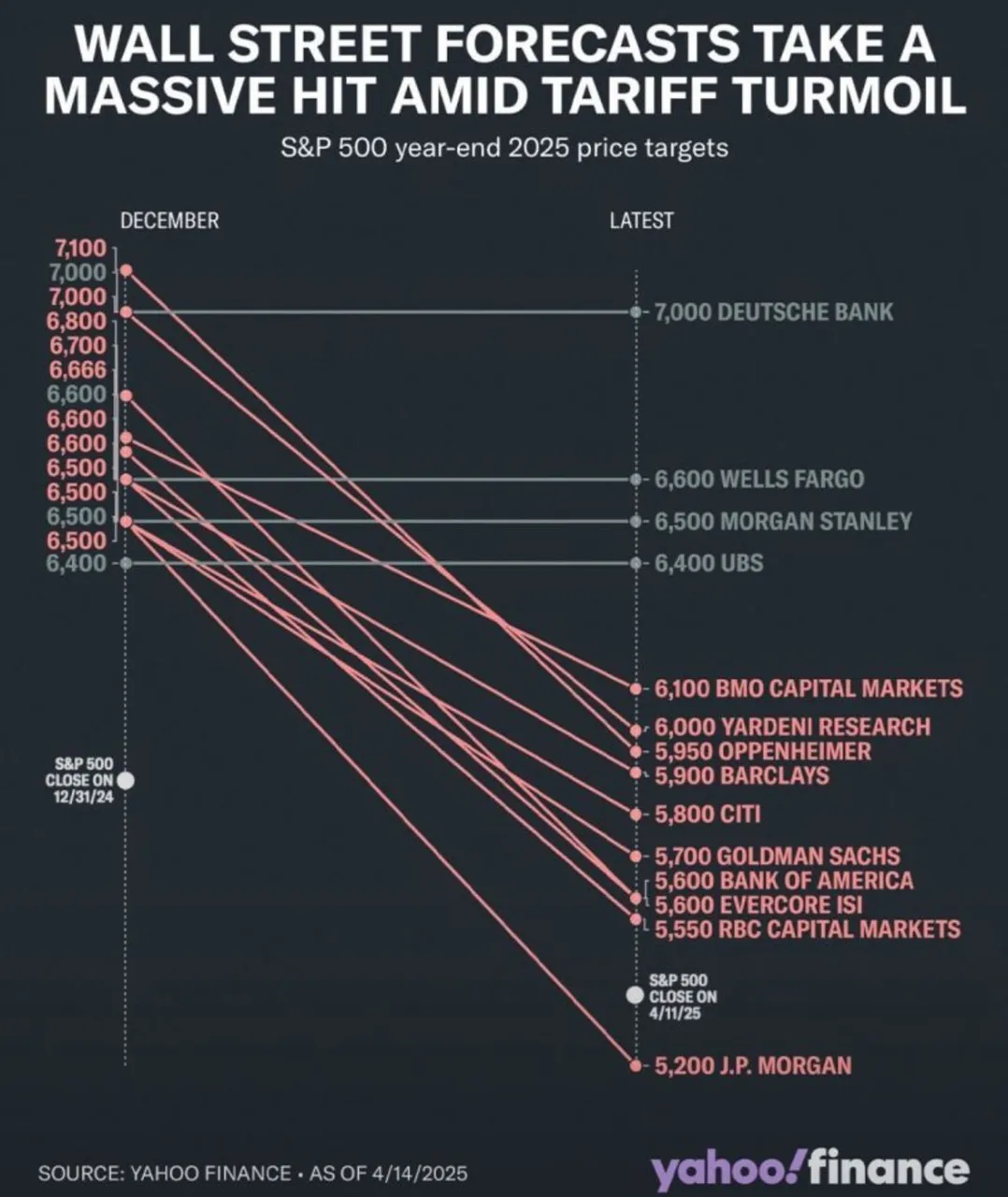

Wall Street might be sophisticated, but it’s not immune to herd behavior. In fact, its access to information and shared models might be making the crowd even tighter. As an observer and participant in the markets, I’ve come to see this as both a warning and an opportunity. There’s room to play the contrarian, room to ride the momentum—but above all, there’s a need to remain nimble and clear-eyed about the risks that come with everyone running in the same direction.

In this kind of environment, diversification, independent thinking, and a healthy respect for the unexpected might be more important than ever.

Discord: @newageinv

Chat with me on Telegram: @NewAgeInv

Follow me on Twitter: @NAICrypto

The following are Affiliate or Referral links to communities and services that I am a part of and use often. Signing up through them would reward me for my effort in attracting users to them:

Start your collection of Splinterlands today at my referral link

Expand your blogging and engagement and earn in more cryptocurrencies with Publish0x! Sign up here!

My go to exchange is Coinbase; get bonuses for signing up!

The future of the internet is here with Unstoppable Domains! Sign up for your own crypto domain and see mine in construction at newageinv.crypto!

Always open to donations!

ETH: newageinv.eth

BTC/LTC/MATIC: newageinv.crypto

Disclosure: Please note that for the creation of these blog posts, I have utilized the assistance of ChatGPT, an AI language model developed by OpenAI. While I provide the initial idea and concept, the draft generated by ChatGPT serves as a foundation that I then refine to match my writing style and ensure that the content reflects my own opinions and perspectives. The use of ChatGPT has been instrumental in streamlining the content creation process, while maintaining the authenticity and originality of my voice.

DISCLAIMER: The information discussed here is intended to enable the community to know my opinions and discuss them. It is not intended as and does not constitute investment advice or legal or tax advice or an offer to sell any asset to any person or a solicitation of any person of any offer to purchase any asset. The information here should not be construed as any endorsement, recommendation or sponsorship of any company or asset by me. There are inherent risks in relying on, using or retrieving any information found here, and I urge you to make sure you understand these risks before relying on, using or retrieving any information here. You should evaluate the information made available here, and you should seek the advice of professionals, as appropriate, to evaluate any opinion, advice, product, service or other information; I do not guarantee the suitability or potential value of any particular investment or information source. I may invest or otherwise hold an interest in these assets that may be discussed here.