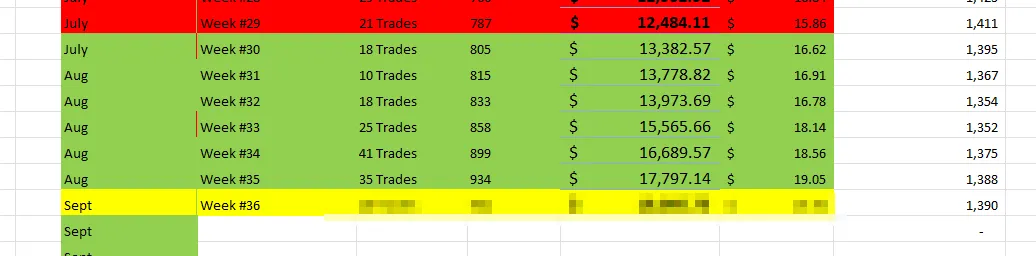

Week36: End of Week Option Summary

- Week 36: Post I made this week.

- Week 36: End of Week Option Summary

- Week 36: 4-5-6 Iron Condor SPY ROI

- Week 36: 4 Iron Condor Visa ROI

- Week 36: ROKU Trades and YTD Data.

- Follow me and see what I do for Week 37 (Sept 11 - Sept 15)

Week36: Post I made this week.

How did I do this week?

- Did you see I posted my options trades within hours of making them?

- I'm one of the few options traders who post this publicly (without paying for it).

- Review of the previous post for Week 36 below:

- @solving-chaos/week36-sept6-option-trade-open-6-dec-15-iron-condor

- @solving-chaos/week36-sept7-option-trade-visa-spy-riot-bac

- @solving-chaos/week36sept-8-options-trades

Week36: End of Week Option Summary

I made over $1K this week and am getting close to my 21K from week#26!

- 28 Option Trades

- $1208 Total. $1004 from Option. $204 from dividend.

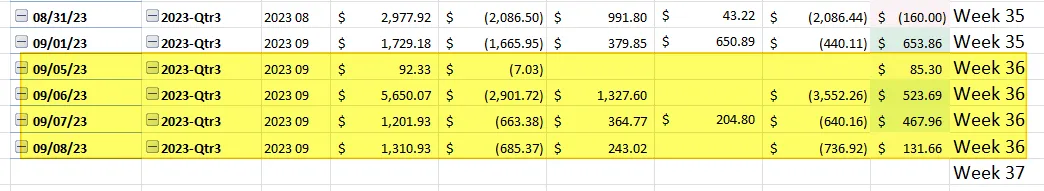

Weekly View

Daily view - Pivot table

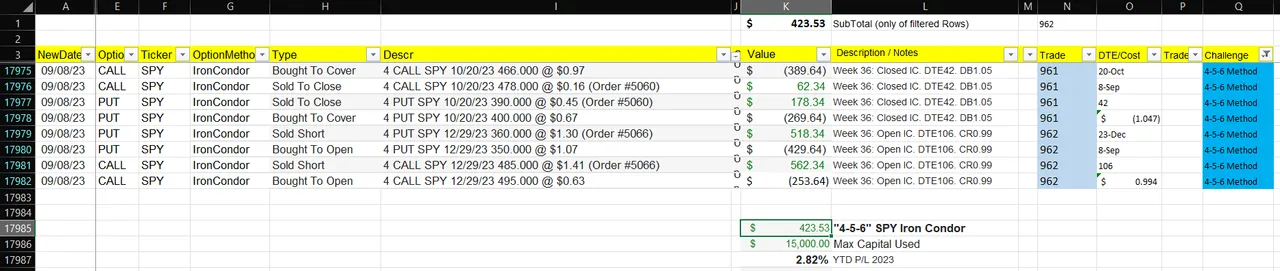

Week 36: 4-5-6 Iron Condor SPY ROI

I have less than 20 weeks to turn this one around. My high was over $4K profit (or around 25% return in June). At least I am going in the right direction now. The challenge is that I am doing much safer trades right now, which will impact my profit per trade. It might be hard to get this back to 15% ROI, but I will see what happens in the market before I do so.

$400 profit using $15K is not a good ROI. I could have made more using FIX INCOME assets. So, I have my work cut out for me in Q3/Q4 of this year.

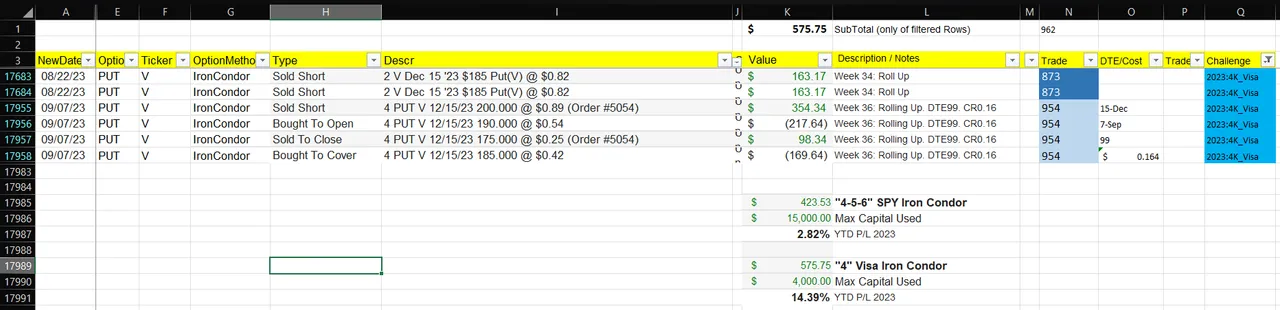

Week 36: 4 Iron Condor Visa ROI

My Visa Iron Condor is also recovering from a 28% ROI in June. I suffered a big loss in July. This one is at $575 profit using 4K of capital all year long. If Visa stays between $225-$260, I think I will be fine going into the end of the year. I might hit 20% ROI using this Iron Condor on Visa.

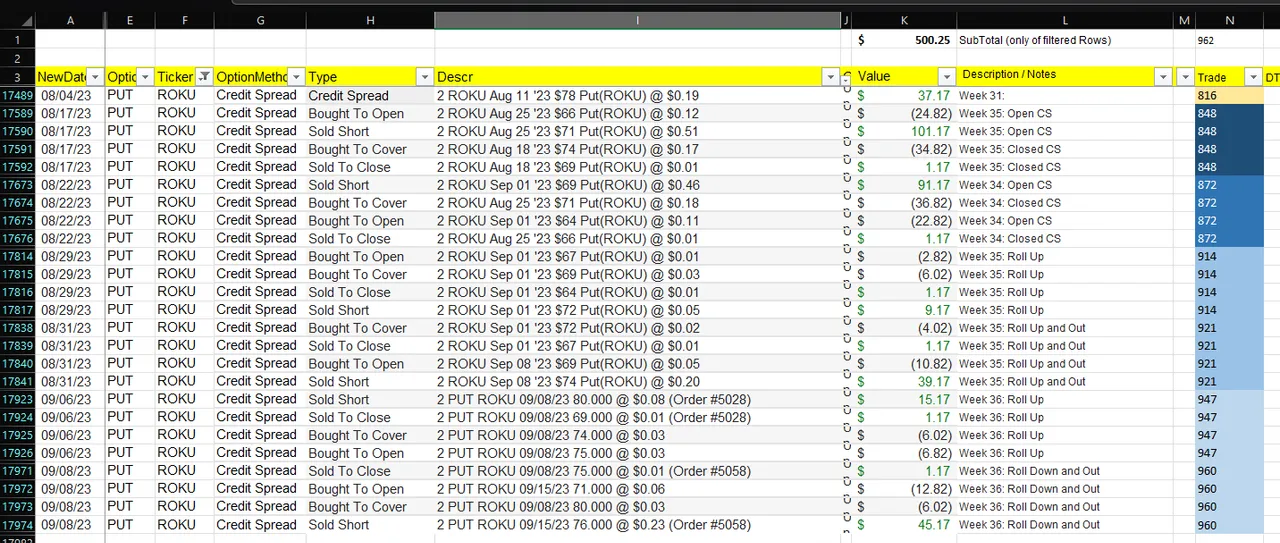

Week 36: ROKU Trades and YTD Data.

I started trading ROKU on week #22. This is a Put Credit Spread using $1K capital at risk. Since then, I have repeated the trades and will see if I can keep making money on this.

- 2023 ROI : $365 so far. $31 for Week 36. $26 Average RETURN per week.

- 1K max capital at risk.

- 36.5% Yearly ROI ($365/$1K). The Weekly Average is about 2.6% ROI.

- Using 2 Put Credit Spread - 5 dollar width (between the two legs).

Follow me and see what I will do for Week 37 (Sept 11 - Sept 15)

I post my trades on LeoFinance/PeakD. Then, I repost using Twitter and Facebook. I aim to do my trades between 9:30 a.m. (EST) and 11 a.m. Then, I create the post on the internet to share with others within the hour (often before 12 noon (EST). I post are available to everyone with access to the internet, and you don't need to be a paid subscriber.

I have been trading for several years and posting my trades online. If you don't believe me, follow me and "audit" my results. The only disclaimer I will make this is All my trades are real money trading accounts (not demo or backtesting software). I post my trades are OPEN or when I Roll the position. Therefore, you can see what I am doing. However, sometimes you don't see ALL my trades because I do over 1000 trades per year, and I talk about a small subset of my trades.

To make this easier to follow, each year, I will pick a trade to do all year long and TAG those in my Excel SHEET to track it. I use to do video to show all this data on my YouTube channel, but it was too much time to edit the videos. So I don't make those anymore. However, I might if there is a strong demand from the USER base for me to show my weekly summary in YouTube Format.

Have a profitable day!

Solving Chaos