A couple days back I wrote an article about the interest collar on our home loan and how paying off more now makes a huge amount of sense. Essentially, because we have a collar at a very low rate for the next 8 years, everything extra we put in will shorten our loan. And the earlier we start, the more impact it will have, as it will benefit from the compounding factors that reduce the principle faster, meaning the interest portion will reduce and more will increasingly go to reducing the principle.

I shared the article with my wife, who still hasn't read it, but decided to see if the internet had anything that would allow me to visualize it more easily, which of course there was. Using this to demonstrate it to my wife allowed me to have the conversation and show her in real time what was actually happening. This was very helpful for her, so I thought it would be worth laying out here too.

There are a few tools out there, but I chose this one because it was quite clean looking and updated on-the-fly as changes were made, which sped up the process. I haven't used one of these before, and while I did do various accounting classes at university, I sucked ass and don't remember how to do this myself. This is somewhere I think tools are useful, as there is very low value in me being able to do this myself, but there is very high value in being able to get the results.

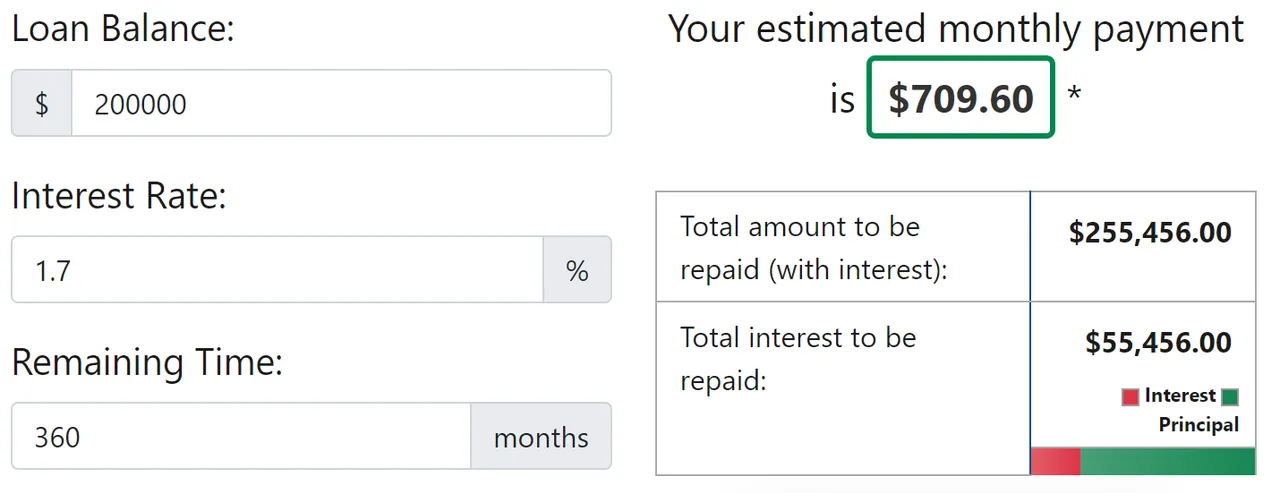

So, to be consistent, I am using the same loan size of 200,000 from the other article, and will plug in my interest rate of 1.7%. However, rather than looking at monthly costs and savings, I want to know how paying higher amounts are going to affect the length of the loan. I have chosen 30 years, so 360 monthly payments.

The first one to start with is the baseline, which is paying back what the bank would suggest gets paid back.

It is very easy to choose to do this at the moment rather than paying more, especially when the economy is tanking, because it keeps money in the hand. However, this is the "trick" with the collar, because this is the longest part of the loan, which means that paying more per month in this period will have more opportunity to compound reduce the principle. However, many don't do this, because often they feel they don't have any extra, as they are younger, likely have lower paid jobs and are starting a family at this point. It gives "security" so the payments are known, but that security comes at a cost of shortening the loan with a multiplier effect.

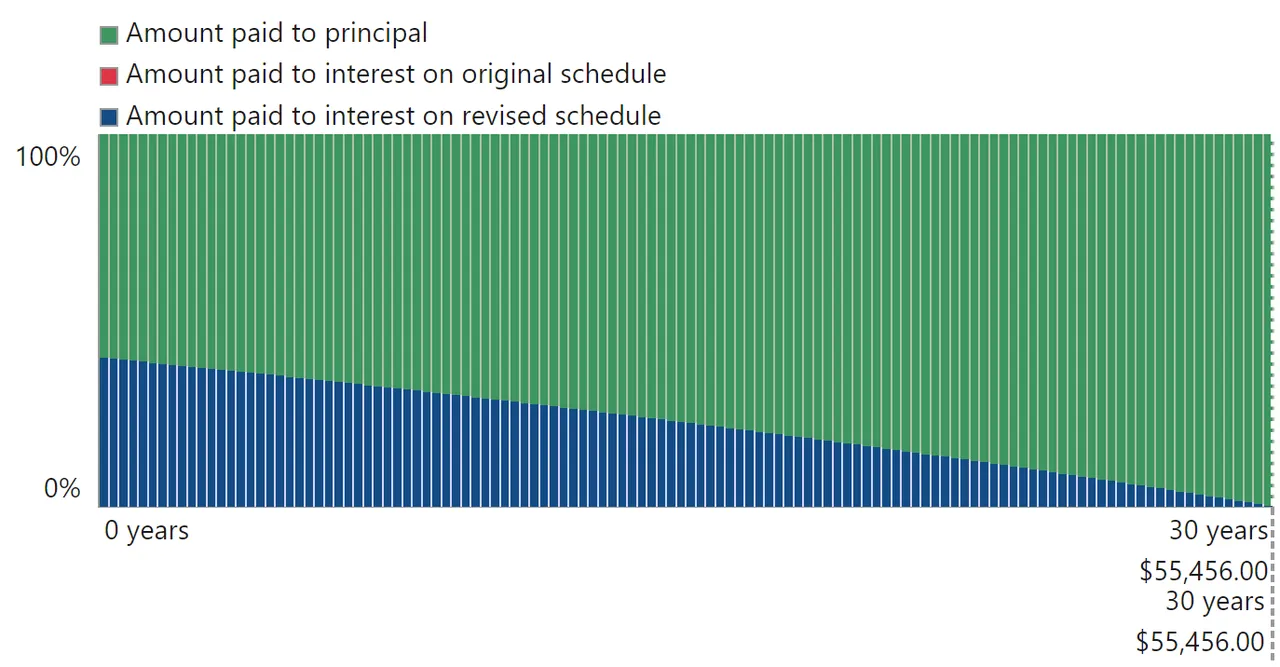

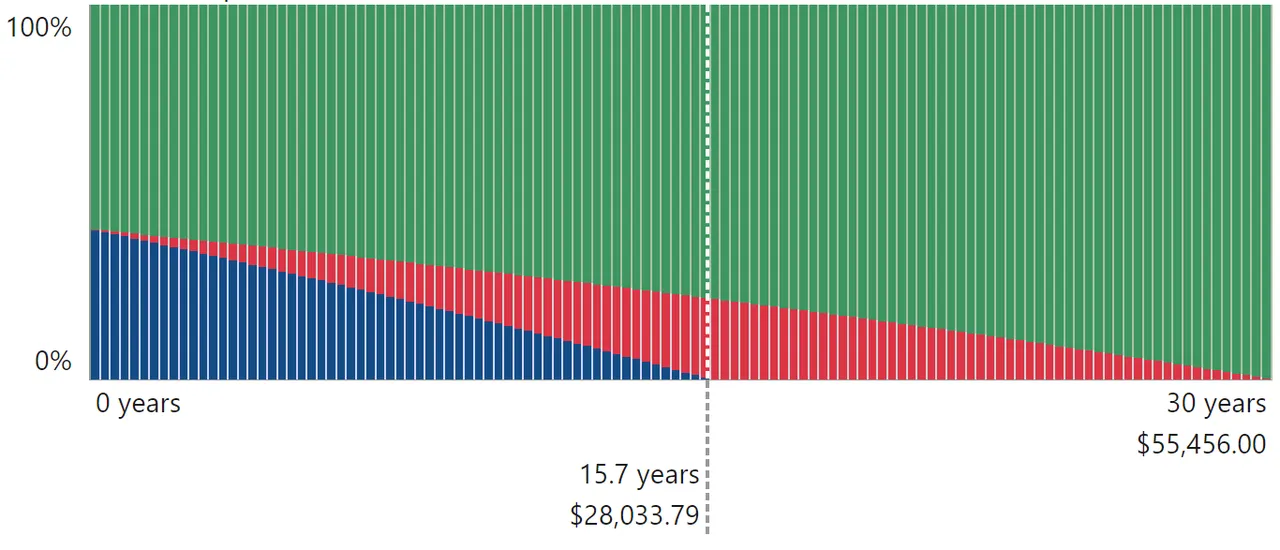

To visualize the baseline:

As you can see, there is no "red" in the graph, as we are paying only the suggested amount. The loan will end at the 30 year point, as the bank planned and we would have paid 55,000 in interest. But as you can see, that isn't right, is it? Because we only have a collar for the next 8 years and we have no idea what the interest rate will be past that point. If it is lower, great, but the chances of that are slim I believe. And, even if it goes lower during our collar, we will pay less than the 1.7% also.

Note: After, I will show parts of the amortization table to show what is happening.

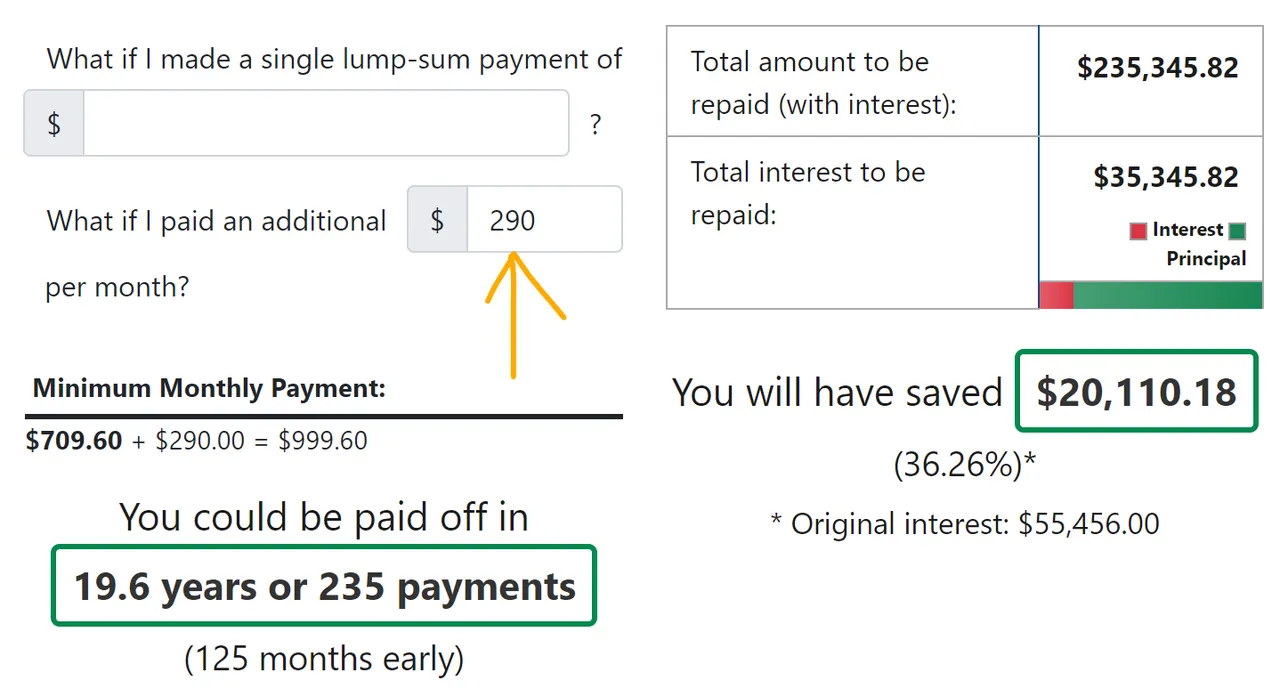

But, what if we were to round our payment up to the even thousand, so add 290 a month to our repayment schedule? That is an increase of about 40% in payment amount.

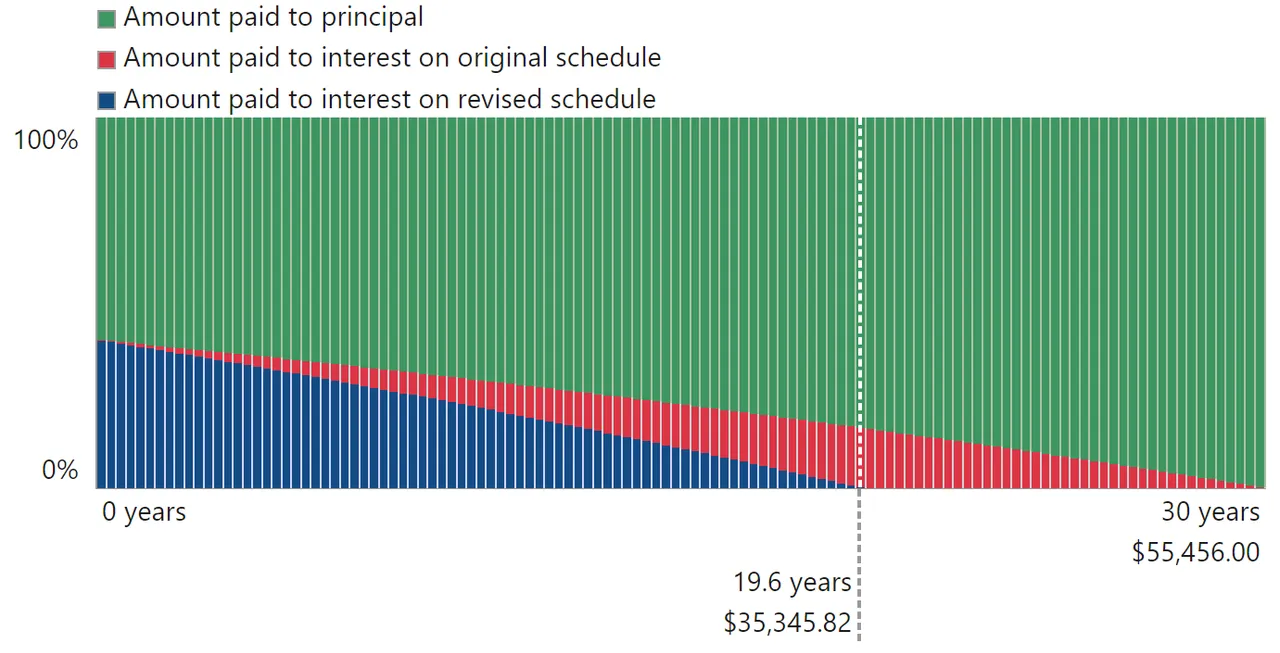

Now, we have saved 20,000 in total interest and we would have reduced the repayment time from 360 months to 235 months. And you can see in the following graph how that looks.

This means that we have reduced our loan length by ten years, or ~33%. But what should be remembered is that this "saving" is more than just on the total interest repayment reduction, because for those ten mortgage-free years, the saving is also the principle payment too. that is 120 months of not paying 1000 dollars a month, so it is 120,000 in savings that could be invested and generate more income.

For instance, if for those ten years the 1000 was invested and gained 10% per year compounded monthly, By the end of the ten years, 120,000 in capital would have been injected and it would be worth 204,000.

Now, you should be looking at that and saying,

"Hey, that is more than the initial house loan"

That is ten years without having a mortgage, making up for the total loan that was going to take 30 years to pay off. Sure, there is some inflation in there too, but you get the idea.

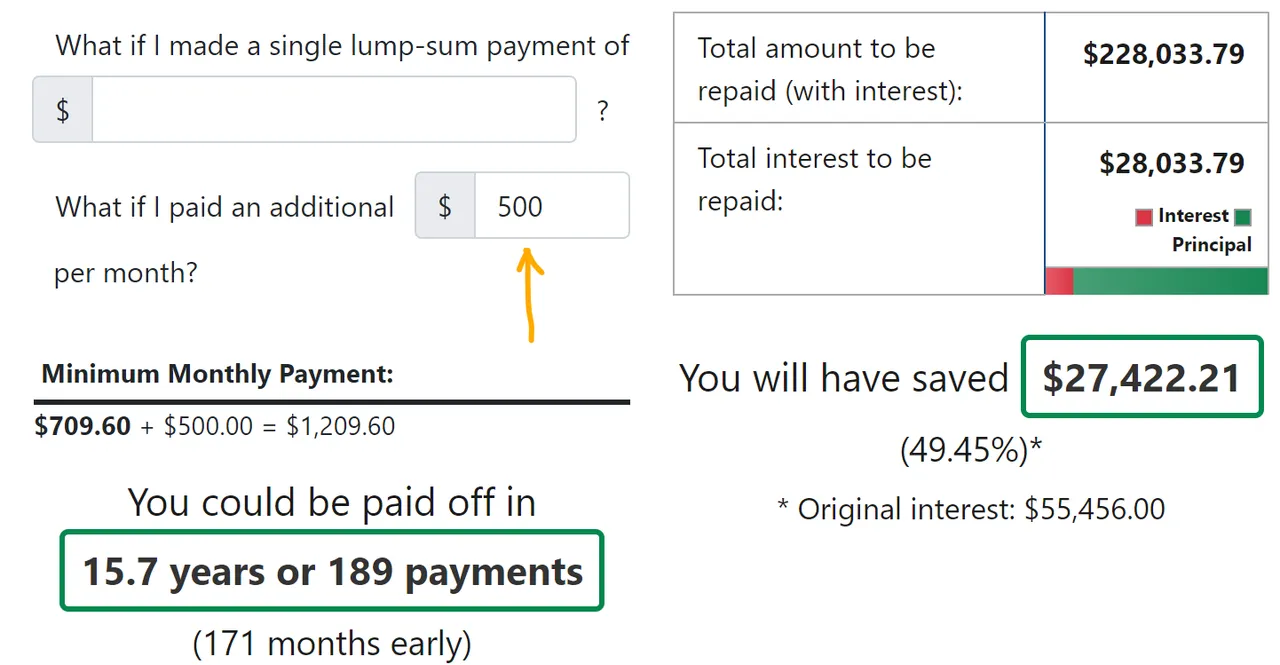

So, what if instead of 290 extra, we scrimped and saved and was able to feed 500 more in a month, so the repayments per month are 1,210.

That almost halves the loan, and if we were to do the same as above with the investment, it would be 1,210 for the next 14 years, the monthly contributions would amount to 168,000 and have a value of 363,000.

If this was our loan and we could shorten it like this, I would be 59 when the loan is paid off and would have extra money going in from that point to top up my super (or invest), after paying all of my compulsory anyway.

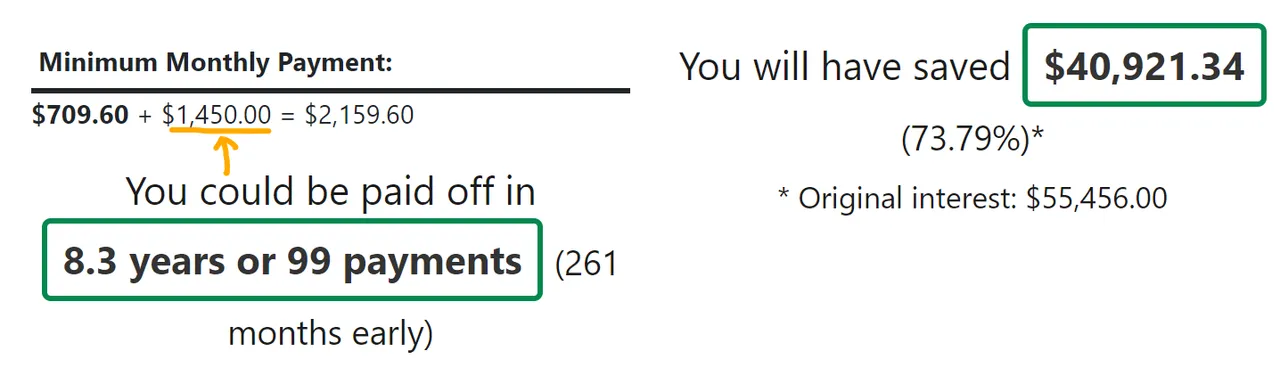

And just for fun, in order to pay it off at the time the collar ends in 8 years, it would take about 1,450 extra month, so payments of around 2,200.

That is likely undoable for us, so lets assume we can add the 500 and it will take about 16 years. Where does that leave us when the collar comes off and we lose our 1.7% ceiling? For this, we look at the amortization table and what principle is left after the 8 years, which is month 96.

But before we do that, let's look at month 1:

The thing to look at is the green side in relation to the red side. The green is how much comes off the principle, the red is how much is paid in interest.

If we go to 4 years:

We can see that with the same monthly payment, we are paying an additional 64 off per month and this increases each month. By the end of the collar at month 96, it looks like this:

That is 130 extra coming off the principle in that month, compared to month 1.

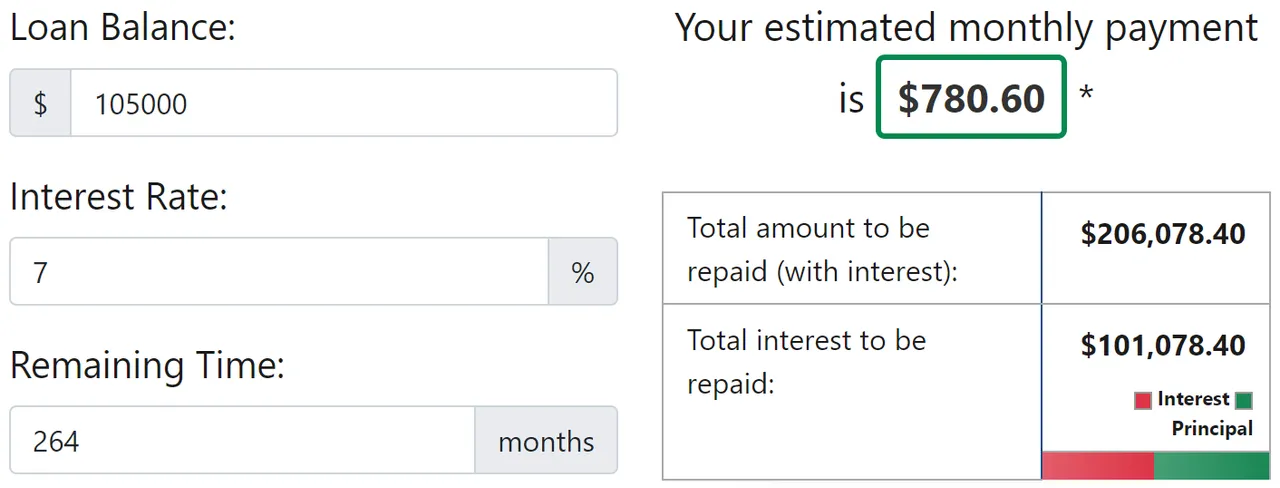

That means there is still about 105,000 left on the loan to pay, over half. But, we are only 26% of the way through the original 30 year loan period. We have smashed it! But there is still that half to pay, so that means that our payments are going to be adjusted based on the principal left and the interest rate, and it will assume there are still 30 years in total, meaning there are 22 years to go. This is the same as a loan of 105,000 for 264 months and whatever the interest rate is at the time. Let's assume 7% for the whole of the 22 years, which is very high, but what it is in many places now, though it will decrease from there in a couple years most likely.

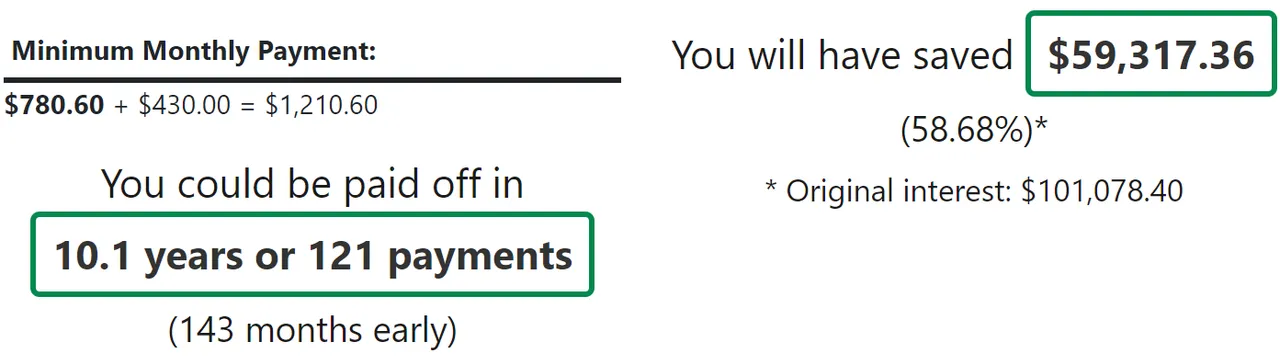

This means that the suggested monthly repayments are 780 dollars and we will finish paying the loan in 22 years, with the interest being almost the same as the 105,000 principle. But, remember we were used to paying 1210 a month with that extra 500 before, so we would continue to do that during this period too. So keeping the same payment we have been making for the last 8 years of 1,210, it would look like this.

A 22 year loan is now a 10 year loan. This means that the total loan of 30 years has been reduced to 18 years, even though the last ten years of that was all at a very high 7% interest rate. And, all of that time, it was the same repayment amount every month, meaning that it was very easy to calculate for those years. And of course, the interest rate on those last years might be significantly lower than 7%, but it is good to factor it at that level, as that is a percentage or two above what they calculate for loan stress testing.

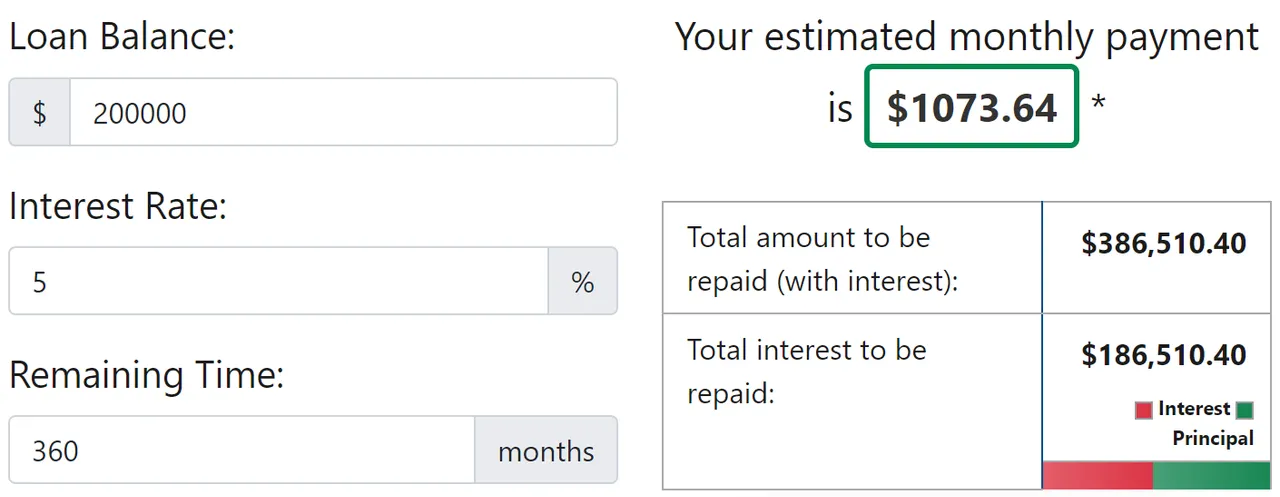

And yes, it might not be possible for everyone to pay back a huge amount extra on their loan each month, but consider the same loan of 200,000 with a static 5% interest rate for 30 years.

That is a monthly repayment of 1073.

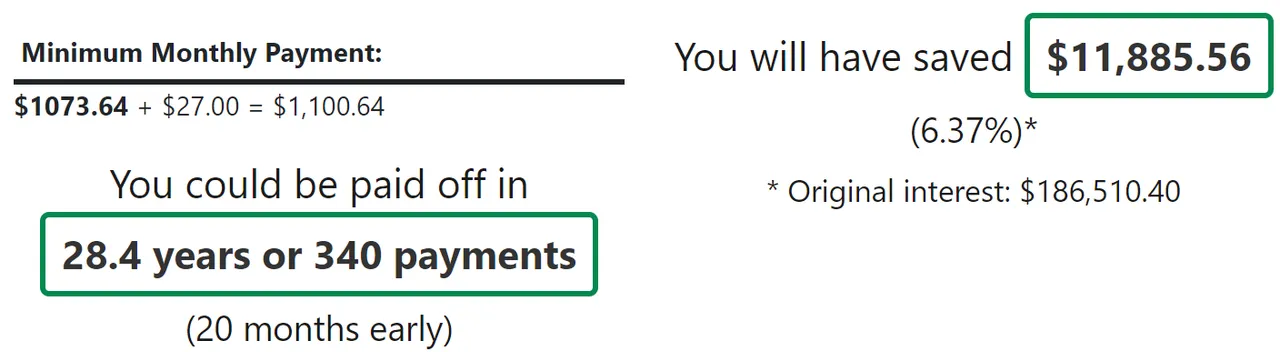

If we round to the next 100 and add 27 dollars a month:

That is 20 months cut off the loan, a saving of 11,885 in interest and, 20x 1100 in the pocket, or 22,000 in that time.

What can you buy for 27 dollars?

(or relative depending on your location)

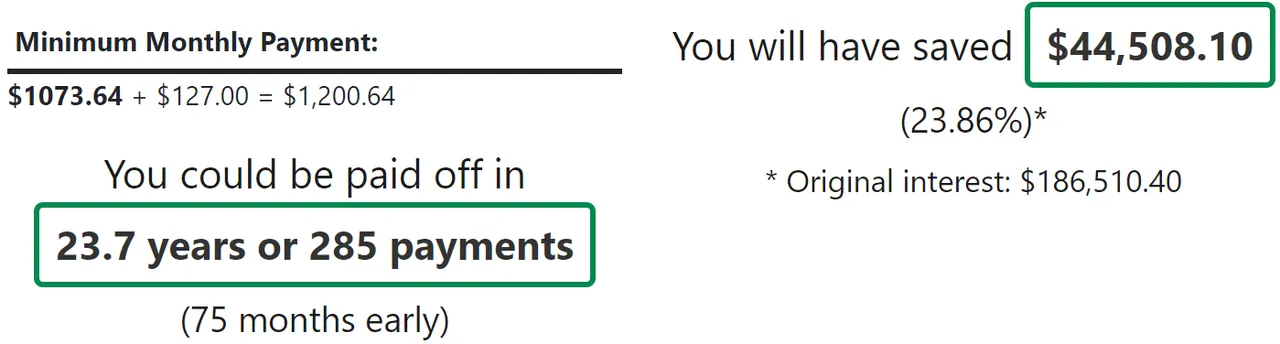

If we round it to the next 100 and pay 1200 a month:

That is almost 6.5 years early, a saving of 44,500 in interest payments and for those years, 75x 1100, or 82,500 cash in total available to invest. Doing the same thing and putting it to investments that earn 10% calculated monthly, after 75 months (6.25 years), it would be worth 114,000.

So, instead of just paying off the mortgage after 30 years and freeing up that 1073 a month, you would have paid off the mortgage years earlier and have 114,000 in your pocket instead.

Worth paying a little extra now?

Taraz

[ Gen1: Hive ]