Since Trump announced sweeping tariffs on April 2nd ("Liberation Day"), stock markets have been tumbling worldwide. The Nasdaq, S&P, and Nikkei have dropped 11%, 7%, 8% respectively, and we could be facing even more carnage come Monday morning.

While some investors are panicking, others have been sitting calmly, confident that things will turn around soon. Why? Because they have made an educated guess that the central banks will bail out the markets yet again, as they've been doing since 1987.

By using their greatest talents - lowering interest rates and printing money - the central banks can always come to the rescue and breath life back into the markets.

Such interventions aren't free of negative consequences though. Consumer inflation got out of hand during the bank's last round of bailouts, officially topping 9% in June of 2022.

Another round of QE and rate cuts could very well lead to hyperinflation.

The Conundrum

The central banks have a dilemma.

If they buckle under the pressure, cut rates and launch QE again, inflation will surge even higher than in 2022.

On the other hand, if they hold steadfast and refuse to cut rates, the markets will continue to fall, and the debt will become unmanageable.

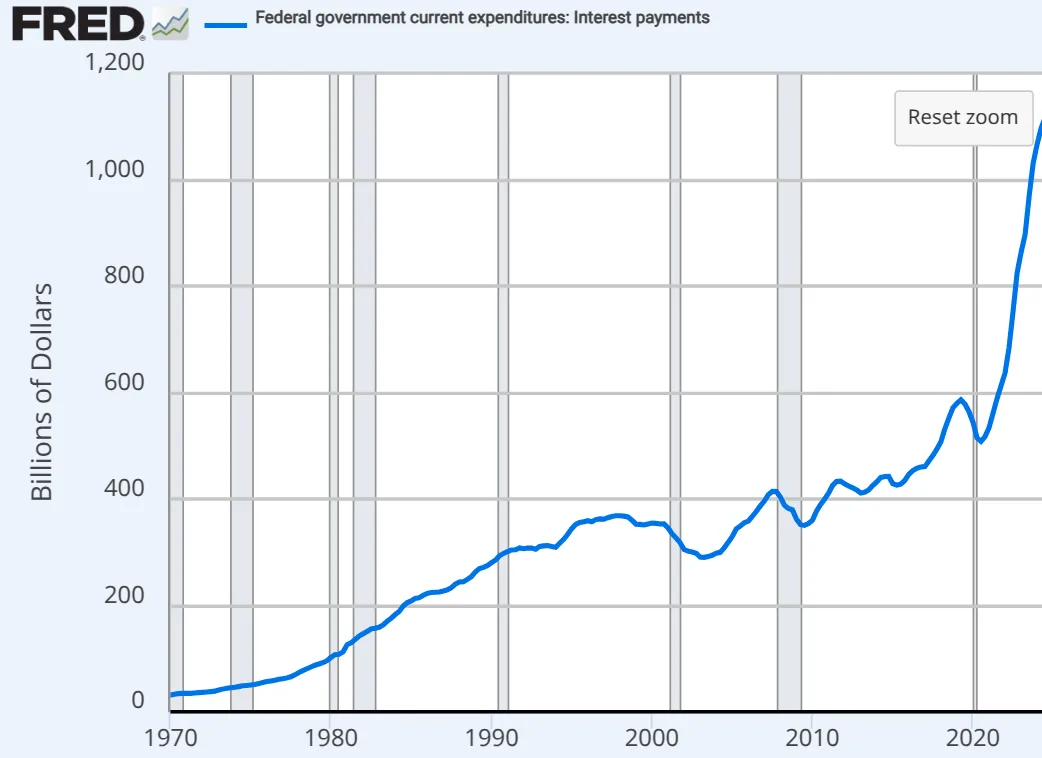

Consider that the US government now owes nearly $37 trillion dollars, and almost $9 trillion of that debt needs to be rolled-over in 2025 at today's much higher interest rates.

With interest payments already at record highs and climbing, the government needs rates to fall substantially if they hope to afford servicing their ever-expanding debt.

Some are speculating that's the reason why Trump announced these tariffs. By crashing the stock market intentionally, the Fed could be forced to have an emergency meeting and cut rates.

The Great Reset

The Fed has been between a rock and a hard place ever since the Great Financial Crisis of '08.

Lowering interest rates blows the Everything Bubble bigger and causes more inflation. On the other hand, raising interest rates causes the stock market to crash and the economy to contract.

What is the ultimate solution to this predicament?

For those who have been paying attention, a lot has been happening over the past decade. Wokeness, Convid-19, record money printing, mass migration, etc. We have to consider that it is all part of a coordinated effort towards a Great Reset.

What about the money itself?

Governments worldwide, especially the European Union, have been pushing the idea of CBDCs for many years now.

Most people are unlikely to accept a CBDC voluntarily. However, they could be persuaded to adopt one an emergency situation, where markets are crashing, or inflation is out of control.

The Alternative

Being borderless, limited in supply, and decentralized, crypto is an alternative solution to this debt predicament we find ourselves in. Crypto has far more potential use-cases than just money, including governance, DeFi, Gaming, DePIN, NFTs, RWAs, and more.

Until next time...

Could this most recent market crash be the catalyst for a deflationary or inflationary collapse of the fiat system? If so, will governments succeed in rolling out their CBDCs, or will cryptocurrencies gain widespread adoption and become the foundation of our future economy?

In any case, you may want to get your popcorn ready for what comes next.

If you learned something new from this article, be sure to check out my other posts on crypto and finance here on the Hive blockchain. You can also follow me on InLeo for more frequent updates.

Further Reading

- Will Bitcoin Be The Base Layer Of The New Financial System?

- Why You Will Survive This Bear Market

- Who Does The World Owe $315 Trillion Dollars To?

Resources

Christine Lagarde Digital Euro Image [1]