Well it looks like the HBD interest rate is on the move. I look at the wallet today and see it is now 15%, which is a significant drop from the 20% it has been paying out for a while now.

Not going into any of the politics around this, people need to make their own opinions and choose their witness votes accordingly. for the record, LBI's policy for now will be to not get involved in witness or proposal voting, and we are looking after the funds of multiple investors.

Plans for HBD interest.

Initially, my plan was to pull an amount out of savings each week to go to the dividend pot equivalent to half of the interest. So, when interest was 20%, I would calculate using the following maths:

- HBD savings * 0.10 /52 = withdrawal.

It's not ideal, but given HBD interest is payed monthly, but we are planning to pay weekly dividends, it was the easiest way to go. This would have meant our HBD balance would still grow at 10%, and we would have a good chunk of funds to go to the weekly dividend.

However, as we can see, the interest can change, and it now has - for now anyway.

So, what I think we should do is drop how much we take out down to 5% for dividends.

On our current balance of just over $5K, that would mean we pull out 5 HBD per week, and 10 would stay in to compound. This would halve in the short run how much will go to the income distribution, but mean we are still growing the HBD balance through compounding a decent proportion of the yield.

Not going to say I am thrilled about this, as in the short term, this HBD interest was going to be the single biggest contributor to the dividends. But the focus of this LBI revamp is long term, and while dividends are nice, asset growth is built in to almost everything we do and HBD is no exception.

The good part is that this has happened before we resumed dividends, so its not like anyone's yield has been cut - just the potential yield.

While we are talking about income...

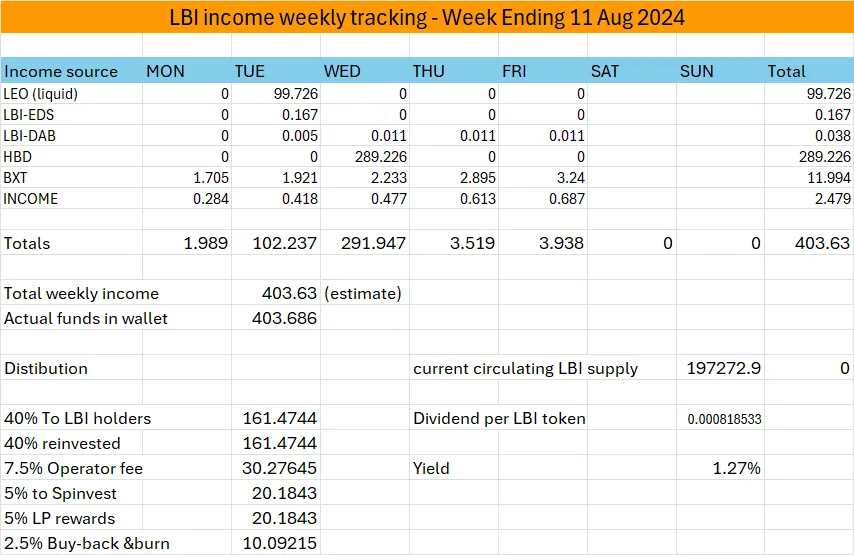

You may be wondering what our current income looks like. Well, so far this week, I have been tracking and will do the full update in the weekly update post. But here is a sneak peak of the week so far:

As you can see, HBD was the biggest chunk, and this will halve from next week in line with the above changes. EDS and DAB wallets are starting out tiny, but will become significant contributors in time. BXT and INCOME will be steady, and grow basically when I buy more of the tokens. LEO is a strange one. This does not include the leo.voter delegation rewards. It is only liquid payouts from posting and curation. And as you can see, we have only received one payout all week. I'm assuming that there is an issue somewhere with Hive Engine, as these are usually paid automatically each day.

Anyway, that shows you a sneak preview of how income will be tracked and divided up. LBI will be a growth token, that pays out a small weekly dividend, not an income token as such. Asset growth tis the main focus, but growing income over time is the secondary focus.

Thanks for reading, let me know your thoughts on the witnesses move to drop the HBD interest rate. Would love to hear both sides of the argument.

Cheers,

JK

@jk6276

If you enjoyed this post, and would like to read some more from LBI, check these out:

Why did LBI buy so much RUG? - just on this one, check out tomorrows update to see how this is going.