Welcome to the Daily Crypto News: A complete News Review, Coin Calendar and Analysis. Enjoy!

🗞 Bitcoin at 'Inflection Point' as Fiat Debasement Rises: Soros Fund Management CIO

- The CIO of Soros Fund Management, Dawn Fitzpatrick, thinks Bitcoin is no longer a "fringe asset."

- She says this is due to growing fear over fiat currency debasement.

- She added that the firm is investing in cryptocurrency infrastructure.

Bitcoin and other cryptocurrencies are at an “inflection point,” and this is partly due to increased money supply in the US, the CIO of Soros Fund Management said yesterday.

Investment banker Dawn Fitzpatrick also said that the investment fund—founded by billionaire investor George Soros—was also investing in cryptocurrency infrastructure, in a Thursday interview with Bloomberg.

“When it comes to crypto generally, I think we’re at a really important moment in that something like Bitcoin might have stayed a fringe asset but for the fact that in the last 12 months we’ve increased money supply in the US by 25% so there’s a real fear of debasing of fiat currencies,” she said.

🗞 US Money Supply to Stay Elevated Despite Coming Slowdown, Pantheon Say

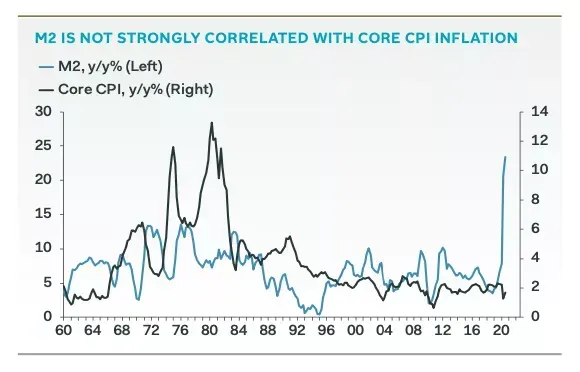

The near 40% jump in the U.S. money supply over the past year sparked concerns about rising inflation, especially in bond markets like U.S. Treasurys. In cryptocurrencies, investors have leaned into bitcoin (BTC) as a potential hedge against inflation, as governments and central banks around the world unleashed massive amounts of economic stimulus.

While a sharp slowdown in the money supply’s expansion is expected over the coming months, the growth is expected to continue at a breakneck pace relative to historical norms, according to a new report by Ian Shepherdson, chief economist at Pantheon Macroeconomics.

- By May, the year-over-year growth rate in M2 money supply – perhaps the broadest gauge of the money supply – will fall dramatically, Shepherdson wrote Thursday in the report.

- "But this would leave it at about 13%, comparable to the fastest growth rates seen during periods of very high inflation in the past," wrote Shepherdson.

- "We reckon that the increase in M2 this year will be about $2.5 trillion to $3 trillion, depending on what happens to bank lending and bank purchases of Treasurys. This implies that M2 will rise by some 13% to 16% in the year to December."

🗞 Chainalysis Raises $100M, Underscoring Surging Demand for Blockchain Surveillance

Chainalysis, a blockchain tracking firm whose client base includes government investigators, crypto exchanges and even financial institutions, raised $100 million in a round that underscores surging demand for cryptocurrency compliance infrastructure.

The Series D raise values the New York firm at $2 billion and was led by Paradigm with participation by Addition Capital, Ribbit and Marc Benioff’s Time Ventures. It comes after November’s $100 million Series C at a $1 billion valuation. In six years Chainalysis has raised $266 million in total.

Chainalysis is among the largest U.S. cryptocurrency investigation firms building software to untangle messy blockchain transaction histories. Crypto transfer records are publicly available but difficult for laypersons to decipher without context, such as flagged wallet addresses and blacklisted coins.

Gronager said private-sector tie-ups continue to be a major source of new partnerships for Chainalysis while its government business, though “super solid,” remains stable. Financial institutions are also beginning to show interest, he hinted.

🗞 NFT craze and institutional money to bring next 100 million crypto users, says Crypto.com CEO

Watch Cointelegraph’s latest interview with Crypto.com CEO Kris Marszalek to understand the catalysts that will push crypto to 200 million users. For more crypto and blockchain content, check out and subscribe to Cointelegraph’s YouTube Channel!

When adoption?

It took over a decade for crypto to reach 100 million users, or ~1% of the global population, according to a study by Crypto.com. But Marszalek expects the next 100 million users to arrive in a far quicker time frame.

He said:

“Going from 100 to 200 million is going to be much, much faster than going from, you know, 50 to 100 [million].”

All aboard the institutional money train

The arrival of notable institutions into the crypto space has signaled to many that mainstream adoption is underway. Household names such as Paypal and Tesla are beefing up their Bitcoin acquisitions and supporting Bitcoin payment rails for non-crypto native customers.

Marszalek commented:

“There is just a whole slew of financial institutions that now are putting a certain portion of their assets into Bitcoin. So that drives quite a lot of action.”

🗞 Daily Crypto Calendar, March, 26th💰

- Elrond (EGLD)

"Starting with Friday March 26 14:30 UTC, the Delegation Manager goes live!"

- HARD Protocol (HARD)

"$HARD Money Market Version 2 is set to launch 15:00UTC Wednesday March 24th. 9:17 AM · Mar 9, 2021"

- ECOMI (OMI)

UltraMan series 1 released on VeVe.

- Measurable Data Token (MDT)

Measurable Data Token (MDT)

- Reef Finance (REEF)

"From our observation of the industry and market trend, AAX plans to add REEFUSDT spot trading pair at UTC 12:00 26 March 2021."

- 🗞 Daily Crypto News, March, 24th💰

- 🗞 Daily Crypto News, March, 23rd💰

- 🗞 Daily Crypto News, March, 22nd💰

- 🗞 Daily Crypto News, March, 21st💰

- 🗞 Daily Crypto News, March, 20th💰

- 🗞 Daily Crypto News, March, 19th💰

- 🗞 Daily Crypto News, March, 18th💰

- 🗞 Daily Crypto News, March, 17th💰

- 🗞 Daily Crypto News, March, 16th💰

- 🗞 Daily Crypto News, March, 15th💰

- 🗞 Daily Crypto News & Video, March, 14th💰

- 🗞 Daily Crypto News & Video, March, 13th💰

- 🗞 Daily Crypto News & Video, March, 12th💰

- 🗞 Daily Crypto News & Video, March, 11th💰

- 🗞 Daily Crypto News & Video, March, 10th💰

➡️ Youtube

➡️ LBRY

➡️ Twitter

➡️ Hive

➡️ Publish0x

➡️ Den.Social

➡️ Torum

➡️ UpTrennd

➡️ Read.cash

➡️ Spotify

➡️ Be paid daily to browse with Brave Internet Browser

➡️ A secure and easy wallet to use: Atomic Wallet

➡️ Invest and Trade on Binance and get a % of fees back

➡️ Check out my video on Unstoppable Domains and get 10$ off a 40$ domain purchase

➡️ Get 25$ free by ordering a free Visa Card on Crypto.com using this link or using this code qs4ha45pvh

Helps us by delegating to @hodlcommunity