In a speech at the economic club in Chicago today, Federal Reserve chairman Jerome Powell responded with a "no" when asked whether or not the central bank would intervene if the stock market were to crash further.

End of The Fed Put?

"b-b-b-but, you saved us every other time since 1987!" - panicked investors.

Yes, ever since the "Black Monday" stock market crash of 1987, investors and traders have become increasingly more dependent on the Fed's liquidity (cash) injections.

Especially after the financial crisis of 2008, when quantitative easing and lower interest rates became the norm to save equities whenever there were signs of distress in the markets.

Eventually bad news about the real economy became good news for the stock market because investors, like Pavlov's dogs, were conditioned to expect stimulus on bad economic data.

So what are the Fed's plans, if not to rescue the markets?

Rates Remain Fixed

In the speech, Powell stated that the Fed is in a “wait-and-see” mode, choosing to hold the benchmark interest rate steady at 4.25% to 4.50% until more data provides clarity on the economy’s direction.

There are two problems with holding rates in that range:

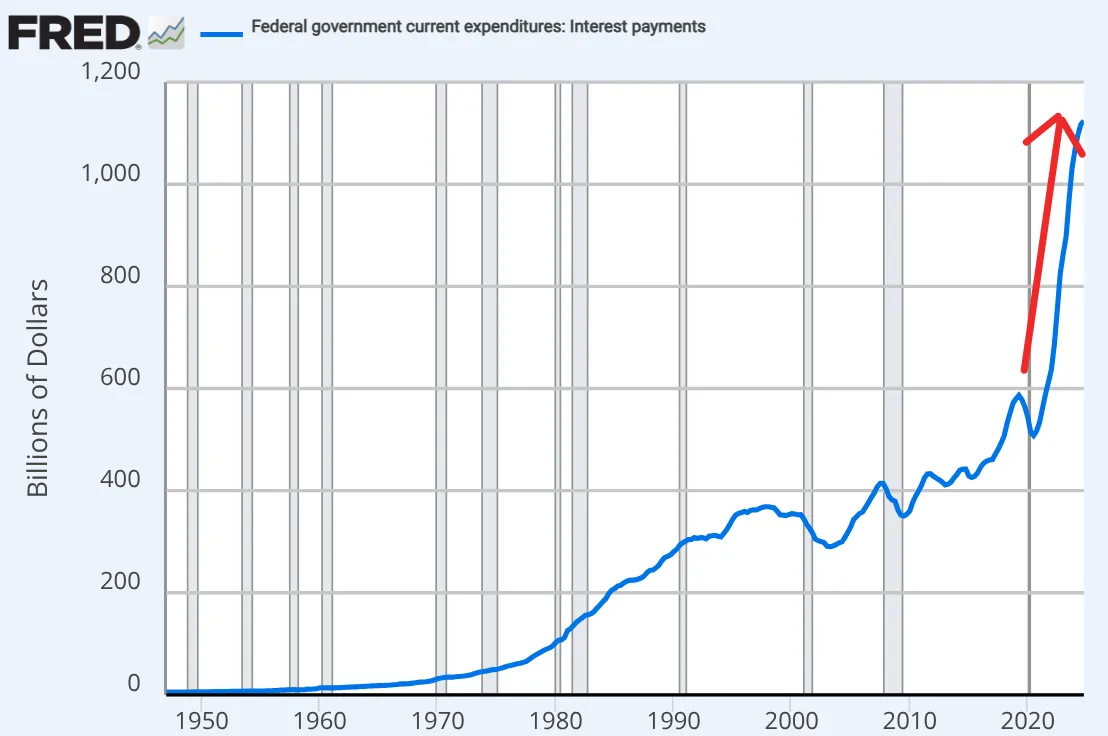

- It further increases interest payments on the federal government's $37 trillion dollar debt (~9 trillion of which needs to be rolled over at higher rates this year).

- It also reduces lending demand and draws reserves (cash) out of the banking system, eventually forcing people to sell stocks.

Despite the risks, the Fed has decided to keep rates where they are, ostensibly due to high employment, and inflation still running hot above their 2% target.

Reserves "Abundant"

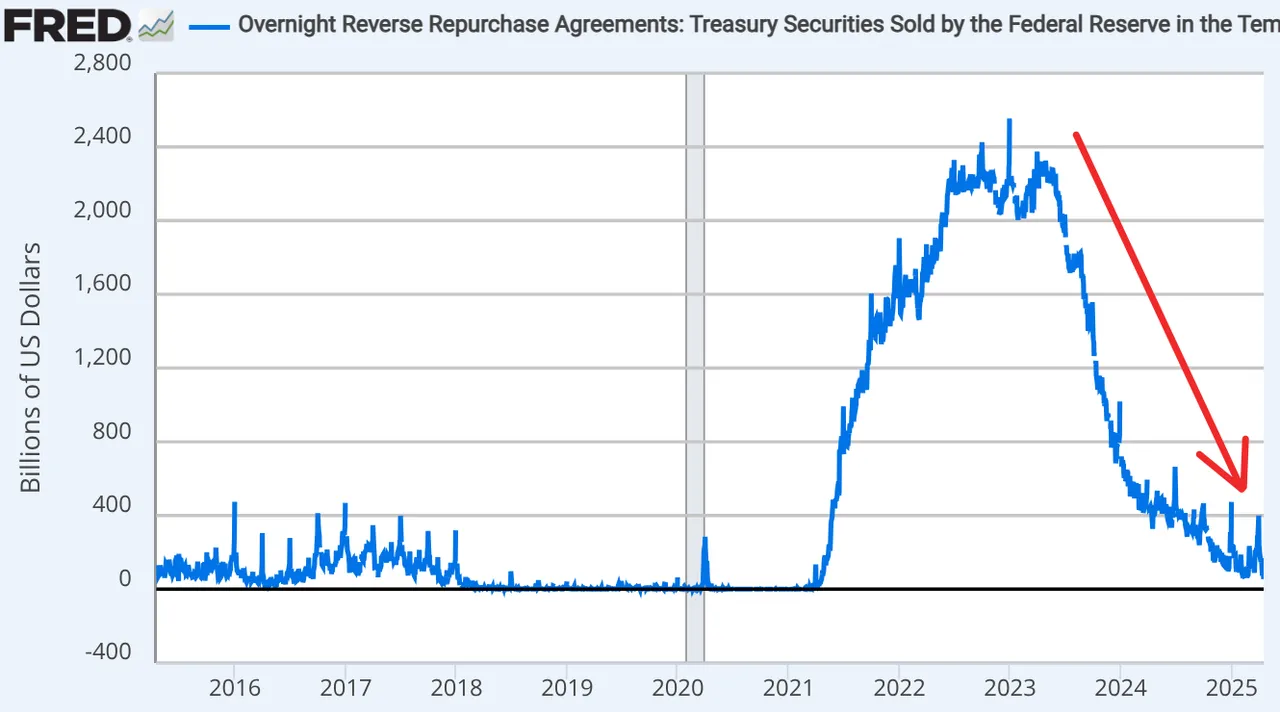

Powell also remarked that "reserves are still abundant", even though the reverse repo facility, a buffer for reserves, has dropped from more than $2 trillion in early 2023 to roughly $50 billion today, indicating a sharp decline in excess liquidity.

A further reduction of the reverse repo could cause short-term rate volatility, and the Fed may have to fire up their printing press again, like they did in 2020, to add liquidity to the system and stimulate the repo's usage.

Such action would essentially be another round of "not-QE" and "not bailouts", and probably send stonks and Bitcoin higher.

In any case, both the stock market and Bitcoin took a sharp dive after investors heard Powell's words.

Bitcoin Decoupling

The question on a lot of people's minds is, when will Bitcoin decouple from the stock market?

Bitcoin has typically moved in line with the Nasdaq, because many investors still consider it to be a "risk-on" asset, rather than a neutral, borderless, and unstoppable form of money.

That said, the trend of investors accepting Bitcoin/crypto as money continues to grow.

It's only a matter of time before Bitcoin and other cryptocurrencies decouple from the stock market, and become recognized as the pillars of our future economy.

Until next time...

If you learned something new from this article, be sure to check out my other posts on crypto and finance here on the Hive blockchain. You can also follow me on InLeo for more frequent updates.

Sources

FRED Reverse Repo Chart [1]

Reverse Repo Explanation By Taylor Kenney [2]

Further Reading

- Could This Stock Market Crash Usher In CBDCs?

- Why You Will Survive This Bear Market

- Who Does The World Owe $315 Trillion Dollars To?