Introduction

In the United States 40% of all the currency every printed in the four-hundred-year history of the country has been printed in the last 2 years.

If anyone tells you that much new currency chasing goods won’t cause inflation, they probably are insincere or ignorant.

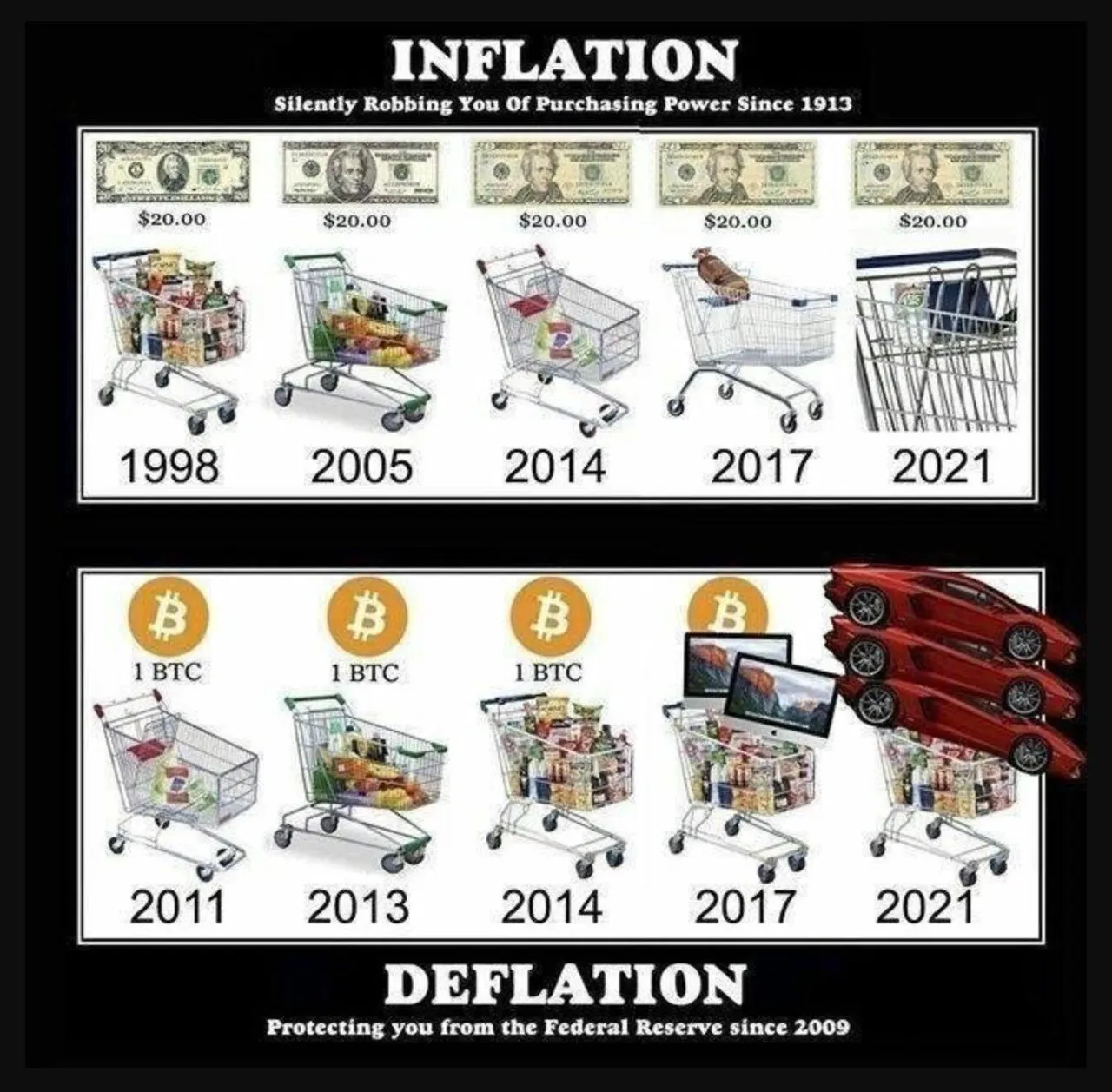

It is s as widely accepted fact of economics that increases in the supply of cash cause inflation. It is also uniformly accepted that inflation causes not only the increased price of goods and services, but it also decreases the value of many countries’ currency.

Inflation is a hidden tax

This inflation, which is an invisible tax, hits the poor, the middle class and people living on fixed income like retirement pensions very hard, as their limited income means devaluation of their currency makes it harder and harder to afford food, shelter and clothing.

Inflation seems to be a world wide phenomenon according to the world bank!

This post-Covid inflation appears to be hitting most of the world’s countries at the same time, and they all seem equally unsure how to deal with it.

A metaphor comparing inflation to fire

I like to use this metaphor: Inflation is consuming the value of national currencies like a house fire consumes your home. But the citizens of these nation states are like home owners trapped in a burning home. They are slowly dying from exposure to heat and flames.

Bitcoin and other cryptocurrencies are like the fire exit.

Let’s unpack or explain this metaphor further:

Bitcoin and other cryptocurrencies are a form of money, they are a store of value, they are mediums of exchange, and they are units of account. They are also like currency, but for a Global Nation of Humans with No Borders. Bitcoin is deflationary, so its value goes up, as the value of national currencies decline.

In a world where everyone’s national currency value is metaphorically being consumed by the fire of inflation, Bitcoin’s value is being increased by the anti-fire of deflation.

Bitcoin is the fire exit from this world-wide inflationary fire.

Inflation is a fire consuming all the value people store in their national currency each year. Bitcoin and it’s deflationary nature is a safe place to store the value of your labor. Many investors recognize this, so there is a lot of interest in Bitcoin and other deflationary assets. These assets have seen a huge increase in the number of people investing in them for these reasons .

Bitcoin and other deflationary cryptocurrency’s are the Fire Exit.

Bitcoin didn't start the fire, it was already burning when Satoshgi invented Bitcoin

The world’s currencies are being consumed by the fires of inflation, raging in practically every nation.

What’s your fire exit?

Bitcoin?

Ethereum?

Hive?

Leo?

@shortsegments

Penned by my hand, February 20th, 20222

Title Picture Source:

Source

Read other posts by @shortsegments:

Leobridge-a-use-case-which-makes-Cubfinance-unique

Can Bitcoin be the next Global Reserve Currency

The World's currencies are on fire with inflation, Bitcoin and Hive are the Fire Exits

Solona Bridge Hack: not your keys, not your crypto, an explanation.

#Bitcoin #cryptocurrency #deflationary #inflation #inflationary #cryptocurrency #hive #leo #bitcoin #ethereum #ether