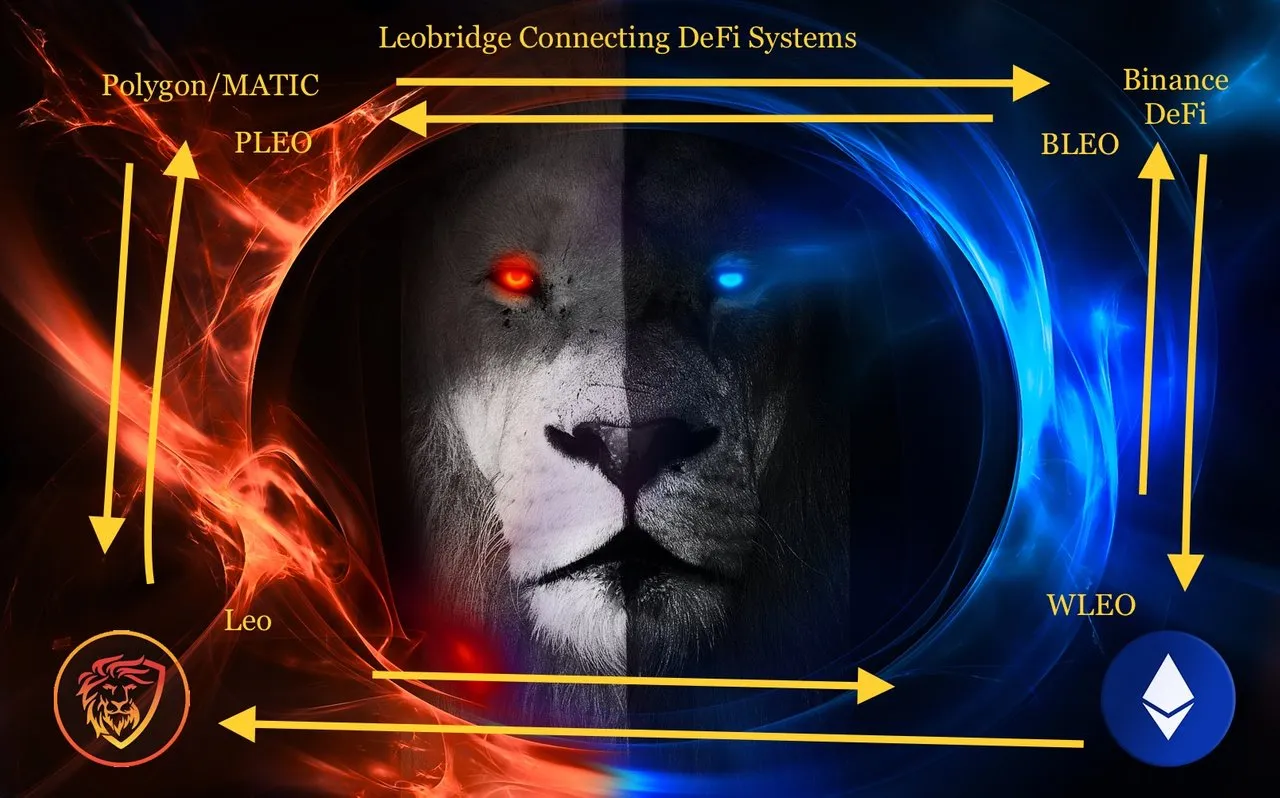

Trusted Bridge

A trusted conduit of investment capitol between decentralized finance projects on the Ethereum blockchain, Binance smart chain and Polygon is in my opinion one of the single biggest differentiating use cases for Cubfinance, and the rapidly expanding collection of ventures under the Leofinance Holding Company umbrella.

Differentiating Leofinance

I agree with Leofinance founder @khaleelkazi that this bridge is a huge differentiator for the Leofinance decentralized finance project Cubfinance, which is one yield farm and staking project in a sea of similar projects.

While Cubfinance has some characteristics as a project which differentiate it from other similar projects, it is the fact that you can transfer value easily from Ethereum to Binance Smart Chain, and soon to Polygon that makes Cubfinance and Leofinance standout.

Rising to the challenge of our time.

One of the biggest challenges according to Ethereum founder Vitallic Buterin is the security of cross blockchain transfers, which are vital to the future of decentralized finance.

In recent talks on these subjects Vitallic Buterin revealed that decentralized finance was an unintended consequence of his creation smart contracts. He added that the proliferation of this form of commerce was unexpected, but once it started he started working on scaling solutions to meet the demand. He then confided that with transaction volume increasing exponentially the only solution was entire new blockchains.

Security

However he emphasized that secure transfers between block chains was a huge security weakness and this topic would cause problems.

Which we have seen in the form of theft from the connections between blockchains, across which investment capitol flows: bridges. And many bridge hacks have one to pass.

Leobridge Trifecta

Trust, Security and Ease of Use.

First, bridges require trust, you must tryst the people running them, and @khaleelkazi has earned our trust.

Second, bridges require security, and @khaleelzaki is focused on security. His code is always audited and frequently beta-tested before release.

Third, bridges should be easy to use. And @khaleelkazi has focused on making the user interface of Leobridge easy to use. An important aspect of Leobridge is that you don’t have to understand what it does to use it.

Mass adoption of new technology requires ease of use. The history of technology shows this is a huge factor in the mass adoption of technology. In general people don’t want to understand how technology works, they just want it to work. Fortunately, @khaleelkazi gets this.

This Trifecta plus the right logistics.

Leobridge features the right connections between these three important blockchains, at this pivotal time when Polygon is growing rapidly and investment capitol is moving.

LeoBridge’s Challenge

As a user, I think the biggest challenge lying before @khaleelkazi and his brilliant team is to keep it simple, make it work, and when it doesn’t work, fix it quickly. You never get a second chance to make a first impression. But that goes for both the first transaction and the first problem. Leobridge doesn’t have to be perfect, but when it doesn’t work, customer service needs to be fast, and courteous.

Good customer service can make a bad first transaction a good first experience, if people feel you treated them fairly and with respect.

Lastly, people don’t remember what you said, but they remember how you made them feel.

Read other posts by @shortsegments:

Leobridge-a-use-case-which-makes-Cubfinance-unique

Can Bitcoin be the next Global Reserve Currency

The World's currencies are on fire with inflation, Bitcoin and Hive are the Fire Exits

Solona Bridge Hack: not your keys, not your crypto, an explanation.